Secretary

SCO 220-221,

Sector 34-A,

Chandigarh - 160022.Tel - 0172-2648321, Fax – 0172-2664758

Chapter-9

Determination of Tariff

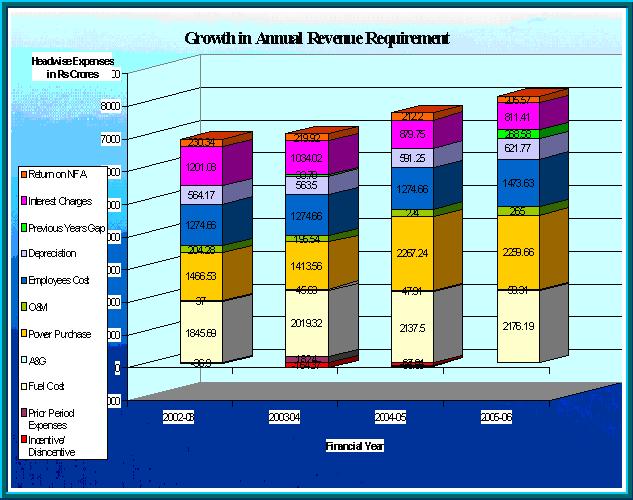

The Board has filed tariff application for revision of tariff rates to meet its Annual Revenue Requirement for the year 2005-06. ARR filings of the Board also include truing up for the year 2003-04 and revised ARR for the year 2004-05. The Board has projected revenue deficit of Rs.1878 crores for the current year and additional deficit of Rs.1476 crores for the years 2003-04 and 2004-05. It has, however, proposed to recover only Rs.1002 crores through increase in tariffs during the current year. The balance deficit of Rs.876 crores for the current year is proposed to be converted to Regulatory Asset while no proposal has been made by the Board for recovery of deficit of Rs.1476 crores projected by it for earlier years. The Board has, however, stated that suitable recovery mechanism needs to be evolved separately. The Commission has determined the ARR for the current year at Rs.7863.54 crores. After making adjustments on account of non-tariff income and revenue from tariff at existing level, the Revenue Gap assessed by the Commission for the current year is a deficit of Rs.500.07 crores, against deficit of Rs.1878 crores for the current year only projected by the Board in its ARR.

The Commission has simultaneously undertaken the final exercise of Truing Up for the year 2003-04. This is consequent to the availability of audited balance-sheet of the Board for that year as well as the specific proposal made by the Board in the current ARR requesting for Truing Up Exercise for the year 2003-04. Similar exercise for the year 2002-03 was suo-moto undertaken by the Commission first time in its last Tariff Order for the year 2004-05. The basic logic behind such exercise is very clear. The Commission initially fixes tariff for a particular year based on estimates which, in turn, are based on certain assumptions which may or may not come out to be true during the year. Even at the time of review of the tariff order in the next Tariff Order, the orders of the Commission are generally based on latest estimates or pre-actuals for that year which are a better indication of the final picture, but not the actual. As a result, after the finalisation of the balance-sheet, a final exercise of Truing Up is necessiated. For the year 2003-04 the Commission first passed the Tariff Order and thereafter undertook review exercise in the Tariff Order for 2004-05. After availability of audited figures for the year 2003-04, the final exercise of Truing Up for the year became essential. As a result of this Truing Up Exercise, net revenue surplus of the Board has been finally worked out at Rs.36.66 crores against the surplus of Rs.262.43 crores earlier determined by the Commission in its Tariff Order dated November 30, 2004. This surplus has been carried forward to the next year for adjustment. The detailed discussion in this regard is contained in Chapter-2 of this order.

The Commission had simultaneously taken up the review of its Tariff Order for the year 2004-05. The logic for undertaking Truing Up Exercise for 2003-04 is already explained above. As a result of this exercise, the ARR for the year 2004-05 is revised to Rs.7567.47 crores as against the original approval at Rs.7424.60 crores. After adjustment of non-tariff income and revenue from the tariff at the existing rates as well as special concessions granted to various categories of consumers under that tariff order, the gap for the year 2004-05 is revised to deficit of Rs.305.24 crores against surplus of Rs.175.86 crores originally approved by the Commission. After including the impact of Truing Up Exercise for the year 2003-04, total gap for the year 2004-05 is now determined at a deficit of Rs.268.58 crores against the surplus of Rs.438.29 crores originally approved by the Commission. The detailed discussion in this regard is contained in Chapter 3 of this order.

Combining the result of all the three exercises, the Commission has come to the conclusion that there is overall total revenue deficit of Rs.768.65 crores. In other words, the combined impact of the three exercises i.e. Truing Up for the year 2003-04, review for the year 2004-05 and assessment for the year 2005-06, is that at the prevalent level of tariffs, the Board is short of revenue by Rs.768.65 crores as compared to its total revenue requirement.

| Sr.No | Category | 00-01 (Actuals) | Estimated sales approved for05-06 | Absolute Increase(4-3) | Percentage Increase |

|---|---|---|---|---|---|

| 1 | 2 | 3 | 4 | 5 | 6 |

| 1. | Domestic | 4261 | 5528 | 1267 | 29.73 |

| 2. | Non-residential | 962 | 1444 | 482 | 50.10 |

| 3. | Small Power | 661 | 707 | 46 | 6.96 |

| 4. | Medium Supply | 1195 | 1581 | 386 | 32.30 |

| 5. | Large Supply | 6266 | 6979 | 713 | 11.38 |

| 6. | Public Lighting | 76 | 123 | 47 | 61.84 |

| 7. | Bulk & Grid supply including Rly. Traction | 390 | 583 | 193 | 49.49 |

| 8. | Agricultural Supply | 5535 | 7000 | 1465 | 26.47 |

| 9. | Total within the State | 19346 | 23945 | 4599 | 23.77 |

A second, though relatively insignificant reason for the emergence of the Revenue Gap is the relative inelasticity of the non-tariff income. If the percentage increase in non-tariff income is less than the percentage increase in the ARR (or the units of energy sold), it would lead to the creation of Revenue Gap.

The third contributory cost for the existence of the Revenue Gap which is required to be made good through tariff changes is the Revenue Gap carried forward from the previous year. This may be positive or negative and may be often quite significant.

Cross subsidy is another important factor in determination of tariff. As already stated above, Section 61 of the Electricity Act, 2003 mandates the Commission to reduce and eliminate cross subsidies. The Act further goes on to say that the cross subsidies should be eliminated within a period to be specified by the Commission.

As the mandate of the Act is clear and specific and cross subsidy is one of the critical factors in determination of tariffs, it is important to understand its meaning. The common understanding of the term 'cross subsidy' is the excess contributions made by a class of consumers over and above the justified contributions to be made on their part. These excess contributions are utilized for cross subsidizing other categories of consumers who may be contributing below their justified share. Hence, the term 'cross subsidy' i.e. cross subsidizing of one section / category of consumers by another section/ category of consumers. In its Tariff Order for the year 2004-05, the Commission had gone beyond the general understanding of the term 'cross-subsidy' and had made serious effort to define the same. In this context, the Commission had also deliberated at length and decided to go by the 'average cost of supply' principle for determining the cross subsidies prevalent in the system. Carrying on the discussion further, the Commission had deliberated at length about various alternative definitions of the term cross subsidy and had finally defined the same to mean as difference between revenue actually realized from a particular category and the cost of supply, expressed as a percentage of average cost of supply.

From the discussion in para 9.2 above, it is clear that the Revenue Gap of the previous year has to be added to the current year's gap to arrive at the aggregate Revenue Gap to be covered through tariff changes. It is, therefore, necessary to consider a change in the definition of cross subsidy adopted by the Commission last year.

The Commission feels that for the purpose of measuring cross subsidy levels, the current year's ARR should be increased/decreased by the Revenue Gap of the previous year and so the yearly average unit cost should be replaced by the combined average unit cost for the purpose of calculation of cross subsidies. Hence cross subsidy is redefined as:

| Average realization from the consumer category | Minus | Combined average unit cost of supply |

| Combined average unit cost of supply | ||

| Sl.No. | Category of consumers | Existing Tariff | Proposed tariff by PSEB | Tariff approved by the Commission | |||||

| Energy Rate P/ KWH | MMCRs./ KW or part thereof | Fixed charges Rs. per KW | Energy chargesP / KWH | MMCRs./ KW or part thereof | Energy Rate P/KWH | MMCRs./ KW or part thereof | |||

| A) PERMANENT SUPPLY | |||||||||

| 1) Domestic supply | |||||||||

| a) Upto 100 units | 200 | 27 | 20 | 0-30 units 200 | 0 | 0-100 221 | 30 | ||

| b) 101 to 300 units | 334 | 20 | 31-100 units 230 | 0 | 101-300 368 | ||||

| c) Above 300 units | 353 | 20 | Above 100 353 | 0 | Above 300 389 | ||||

| 2) Non-Residential | 384 | 99 | 50 | 384 | 0 | 423 | 109 | ||

| 3) Public lighting | 384 | As per 8 hrs/ day | 75 | 384 | 8 | 423 | As per 8 hrs/ day | ||

| 4) Irrigation tubewells | i)Without Govt. subsidy 194 Ps / kwh or Rs. 205/BHP / Month ii) With Govt. subsidy 57 Ps / kwh or Rs. 60 / BHP / Month | N.A. | Unmetered Mono-block pumps sets Rs.225 per BHP Per month Unmetered Submersible pump sets Rs.286 per BHP Per month Metered 213 paise/unit | i) Without Govt subsidy 214 paise/unit or Rs.208/BHP/ Month ii) With Govt subsidy 62 paise/unit or Rs.60/BHP/Month | N.A. | ||||

| 5) Industrial supply | |||||||||

| a) Small power | 306 | 81 | 35 | 306 | 0 | 337 | 89 | ||

| b) Medium supply | 337 | 108 | 75 | 337 | 0 | 372 | 119 | ||

| c) Large supply | |||||||||

| i) General industry | 337 | 108 | 100/ KVA | 337 | 0 | 372 | 119 | ||

| ii) PIU | 337 | 297 | 150/ KVA | 337 | 0 | 372 | 328 | ||

| iii) Arc Furnace | 337 | 283 | 150/KVA | 337 | 0 | 372 | 312 | ||

| 6) Bulk supply | |||||||||

| HT LT | 346 368 Avg. 357 | 162/KVA 162/KW | 100/KVA 35/KVA | 346 368 | 0 0 | 382 406 Avg. 394 | 179/KVA 179/KW | ||

| 7) Railway traction | 402 | 162/KVA | 100 per KVA | 402 | 0 | 443 | 179/KVA | ||

| 8) Outside state | 248 | N.A. | 248 | N.A. | |||||

| B) SEASONAL INDUSTRY : COTTON GINNING, PRESSING AND BAILING PLANT, RICE SHELLERS / HULLER MILLS, RICE BRAN STABILIZATION UNITS (WITHOUT T.G. SETS) (SP, MS, LS) | |||||||||

| a) During season (1st Sept. to 31st May) next year SP MS LS | Relevant industrial tariff as per A (5) | 297 297 297 | 35 75 100 | 363 337 337 | 0 0 | Relevant industrial tariff as per A (5) | 328 328 328 | ||

| b) Off season SP MS LS | 363 391 388 | N.A. N.A. N.A. | 35 75 100 | 363 391 388 | 0 0 0 | 400 431 428 | N.A. N.A. N.A. | ||

| C) ICE FACTORY & ICE CANDIES AND COLD STORAGE | |||||||||

| a) season (April to July) SP MS LS | 306 337 337 | 405 (April to July) | 35 75 100 | 306 337 337 | 0 0 0 | 337 372 372 | 447(April to July) | ||

| b) Off season SP MS LS | -do- | 81 81 81 | 35 75 100 | 306 337 337 | 0 0 0 | -do- | 89 89 89 | ||

| D) GOLDEN TEMPLE, AMRITSAR AND DURGIANA TEMPLE, AMRITSAR | |||||||||

| Golden Temple, Amritsar | |||||||||

| a) First 2000 units | Free | N.A. | 20 | 0 | 0 | Free | N.A. | ||

| b) Beyond 2000 units | 273 | N.A. | 20 | 281 | 0 | 301 | N.A. | ||

| Durgiana Temple, Amritsar | |||||||||

| a) First 2000 units | As per pattern applicable for Golden Temple, Amritsar. | ||||||||

| b) Beyond 2000 units | |||||||||

| E) TEMPORARY SUPPLY | |||||||||

| i) Domestic | 601 | Rs. 500 or Rs. 100/KW whichever is higher | 691 | Higher of Rs.575 or Rs.115 per KW | 663 | Rs.551 or Rs.110/KW whichever is higher | |||

| ii) NRS | 601 | Rs. 1000 or Rs. 250 / KW whichever is higher | 691 | Higher of Rs.1150 or Rs.285 per KW | 663 | Rs.1102 or Rs.276/KW whichever is higher | |||

| iii) Industrial (SP, MS & LS) | As per tariff approved at A(5) above for permanent supply + 100% | Rs. 400 / KW of sanctioned load | 775 | 460 | As per tariff approved at A(5) above for permanent supply + 100% | Rs.441/KW of sanctioned load | |||

| iv) wheat thrasher | -do- | -do- | 775 | 460 | -do- | -do- | |||

| v) Fairs, exhibition & melas Congregations | Bulk supply tariff as at A(6) + 50% | Rs. 4000 per service | 615 | 4600 | Bulk supply tariff as at A(6) + 50% | Rs.4411 per service | |||

| vi) Touring Cinemasa a)Lights and fans b) Motive load | 601 Rate for Industrial permanent supply as at A(5) + 100% | For (a) and (b)Rs. 1000 or Rs. 250/KW of sanctioned load whichever is higher | SP 691 MS 704& LS 775 | Higher of Rs.1150 or Rs.285 per KW | 663Rate for Industrial permanent supply as at A(5) + 100% | For (a) and (b) Rs.1102 or Rs.276/KW of sanctioned load whichever is higher | |||

The Commission approached the State Government for its views on the Annual Revenue Requirement & Tariff Application of the Board for the year 2005-06 as well as Revised Estimates for the year 2004-05. Views of the Government were also sought on specific issues raised by the Commission in its reference to the Government. The same were received vide Government's reference No.11/21/2005-EB5/325 dated May 03, 2005 and have been discussed in detail in para 6.41 of Chapter-6. These were also duly taken into consideration while finalizing the Commission's views on the Annual Revenue Requirements and Tariff Applications of the Board. The Government was further approached for its views on the amount of subsidy to be provided by the Government and the particular consumer class/classes for which the subsidy will be meant. In this connection, Commission's DO letter No.PS/116 dated May 19, 2005 is relevant, a copy of which is attached as Annexure-I to this Chapter. Through this letter, the Government was also requested to convey its views at the earliest so that the tariff order could be issued in the time frame stipulated in the Electricity Act, 2003. As no reply was received from the Government, a reminder was issued vide Commission's reference dated June 01, 2005 and the Government was apprised that the Commission is mandated to issue the Tariff Order by June 08, 2005.

In response to the above correspondence from the Commission, the Government has furnished its reply vide its reference dated June 07, 2005. A copy of the reference of the Government is enclosed as Annexure-II to this Chapter. It has been indicated that the Government had decided that in 2005-06 the agricultural pumpset consumers should pay the same rate of tariff as last year i.e. Rs.60/BHP/month. The Government will accordingly provide subsidy to the tune of Rs.1065.18 crores. The Government will also provide subsidy of Rs.50 crores as last year for SC domestic consumers. It has also been confirmed that the Government would provide additional amount of Rs.68.25 crores determined by the Commission on account of truing up of agricultural load/consumption for the years 2003-04 and 2004-05.

The Commission accepts the decision of the Government regarding grant of subsidy. The same has been incorporated in the tariff structure for working out the tariffs payable by the consumers subsidized by the Government.

Any tariff determination exercise undertaken by the Commission will need to be tested on the touch stone of its effect on cross subsidy levels in the system. As already discussed above in para 9.5, the Commission has decided to revise tariff rates of all categories upward across the Board by 10.27%.

Further, the Commission has worked out aggregate quantum of the cross subsidies in the system for each category of consumers on the basis of combined average cost of supply. As discussed above in para 9.3, the combined average cost of supply has been used for determining cross subsidy only. This has been done both under the existing tariff structure for the last year as well as the tariff structure now approved by the Commission for the current year. To this purpose, the Commission has worked out total revenue realized from each of category of consumers. This itself falls under three categories (a) Revenue from Sale of Electricity (b) Revenue from PLEC, MMC etc. and (c) Revenue from Other Income. Revenue from Sale of Electricity is directly calculated with reference to units consumed and the tariff rate applicable. The revenue from MMC and PLEC had been shown for each category separately in the Tariff Order for 2004-05 and these have been adopted as such for the current year as well. The category-wise details of revenue from Other Income are not available and as such, this revenue has been assumed to be on pro-rata basis with reference to MUs sold to a particular category of consumers. Combining the effect of all the three, total realization from each consumer class has been worked out. When compared with the expected revenue, this gives variation between the expected revenue and the actual revenue realization or the aggregate quantum of cross subsidy in absolute terms. Spreading the same over expected revenue from each category, we get the percentage aggregate quantum of cross subsidies required or contributed by each category of consumers. Table 9.3 below works out the total revenue realized from each category of consumer and the aggregate quantum of cross subsidies generated/utilized under the existing tariff structure and the Table 9.4 gives the picture under the tariff structure now approved by the Commission. Table 9.5 compares the aggregate quantum of cross subsidies in the system for the year 2004-05 and for the year 2005-06 after the tariff revision through this Tariff Order.

It may, however be pertinent to point out here that aggregate quantum of cross subsidy in the system is dependent on number of factors namely, the total quantum of energy sales, the consumer mix, the tariff structure of various categories and the combined average cost of supply. Accordingly, the aggregate quantum of cross subsidy may differ even when the tariff structure of various categories of consumers and the combined average cost of supply remain the same, in case the total quantum of energy supply in the system or the consumer mix change. Both these factors are not so directly related to the tariff structure and as such the Commission had consciously decided not to take into consideration the aggregate quantum of cross subsidy or percentage thereof for working out the cross subsidy for the purpose of the Act. The cross subsidy has been defined by the Commission on per unit basis and not on aggregate of the total quantum of energy supply. Tables ahead are only to give general indication of the total quantum of cross subsidy generated and utilized in the system and do not require to be considered for any other purpose.

Combined average cost of supply = 299.17 paise/unit

| Sr. No. | Category | Energy Sales (MU) | Existing tariff (Ps/Unit) | Revenue with existing tariff (Rs crores) | PLEC+MMC etc. (Rs. Crores) | Non Tariff Income (Rs. Crores) | Total Revenue (Rs. Crores) (5+6+7) | Expected Revenue with combined average cost of supply (Rs. Crores) | Cross Subsidy Generated (+) Utilized (-) (8-9) |

|---|---|---|---|---|---|---|---|---|---|

| 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 |

| 1 | Domestic | ||||||||

| a) | Upto 100 | 2833 | 200 | 566.60 | 12.15 | 39.81 | 618.56 | 847.55 | -228.99 |

| b) | 101-300 | 1287 | 334 | 429.86 | 5.52 | 18.09 | 453.46 | 385.03 | 68.43 |

| c) | >300 units | 1030 | 353 | 363.59 | 4.42 | 14.47 | 382.48 | 308.15 | 74.33 |

| Total | 5150 | 1360.05 | 22.10 | 72.37 | 1454.52 | 1540.73 | -86.21 | ||

| 2 | NRS | 1306 | 384 | 501.50 | 40.41 | 18.35 | 560.27 | 390.72 | 169.55 |

| 3 | Public Lighting | 111 | 384 | 42.62 | 1.56 | 44.18 | 33.21 | 10.97 | |

| 4 | Industrial | ||||||||

| a) | SP | 703 | 306 | 215.12 | 11.55 | 9.88 | 236.55 | 210.32 | 26.23 |

| b) | MS | 1447 | 337 | 487.64 | 13.67 | 20.33 | 521.64 | 432.90 | 88.74 |

| c) | LS | 6979 | 337 | 2351.92 | 99.98 | 98.07 | 2549.98 | 2087.91 | 26.23 |

| Total | 9129 | 3054.68 | 125.20 | 128.29 | 3308.17 | 2731.12 | 577.05 | ||

| 5 | Bulk Supply | 437 | 357 | 156.01 | 1.50 | 6.14 | 163.65 | 130.74 | 32.91 |

| 6 | Rly. Traction | 117 | 402 | 47.03 | 1.64 | 48.68 | 35.00 | 13.68 | |

| 7 | Common Pool | 381 | 75.37 | 5.35 | 80.72 | 113.98 | -33.26 | ||

| 8 | Outside State | 360 | 89.46 | 5.06 | 94.52 | 107.70 | -13.18 | ||

| 9 | AP | 6563 | 194 | 1273.22 | s92.23 | 1365.45 | 1963.45 | -598.00 | |

| Total | 23554 | 6599.95 | 189.21 | 331.00 | 7120.16 | 7046.65 | 804.16 | -730.65 |

This means that Rs.804.16 crores of cross subsidy is generated at existing levels of tariff whereas Rs.730.65 crores cross subsidy is required thereby implying a surplus of Rs.73.51 crores which is almost equal to concession to rural domestic consumers allowed last year but not taken into consideration for the purpose of calculation of revenues and cross subsidies.

Combined average cost of supply = 329.42 paise/unit

| Sr.No | Category | Energy Sales (MU) | Revised tariff paise/unit | Revenue with Revised tariff (Rs. Crores) | PLEC+MMC etc. (Rs. Crores) | Non tariff income(Rs. Crores) | Total Revenue (Rs. Crores) (5+6+7) | Expected Revenue with combined average cost of suply(Rs. crores) | Cross Subsidy generated (+) Utilised (-)(8-9) |

|---|---|---|---|---|---|---|---|---|---|

| 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 |

| 1 | Domestic | ||||||||

| a) | Upto 100 | 3040 | 221 | 671.84 | 13.40 | 41.87 | 727.11 | 1001.44 | -274.33 |

| b) | 101-300 | 1382 | 368 | 508.58 | 6.09 | 19.03 | 533.70 | 455.26 | 78.44 |

| c) | 300 units | 1106 | 389 | 430.23 | 4.87 | 15.23 | 450.33 | 364.34 | 85.99 |

| Total | 5528 | 1610.65 | 24.36 | 76.13 | 1711.14 | 1821.03 | -109.89 | ||

| 2 | NRS | 1444 | 423 | 610.81 | 44.56 | 19.89 | 675.26 | 475.68 | 199.58 |

| 3 | Public Lighting | 123 | 423 | 52.03 | 1.69 | 53.72 | 40.52 | 13.20 | |

| 4 | Industrial | ||||||||

| a) | SP | 707 | 337 | 238.26 | 12.74 | 9.74 | 260.74 | 232.90 | 27.84 |

| b) | MS | 1581 | 372 | 588.13 | 15.07 | 21.78 | 624.98 | 520.81 | 104.17 |

| c) | LS | 6979 | 372 | 2596.19 | 102.28 | 96.12 | 2794.59 | 2299.02 | 495.57 |

| Total | 9267 | 3422.58 | 130.09 | 127.63 | 3680.30 | 3052.74 | 627.56 | ||

| 5 | Bulk Supply | 460 | 394 | 181.24 | 1.65 | 6.34 | 189.23 | 151.53 | 37.70 |

| 6 | Rly. Traction | 123 | 443 | 54.49 | 1.69 | 56.18 | 40.52 | 15.66 | |

| 7 | Common Pool | 381 | 75.37 | 5.25 | 80.62 | 125.51 | -44.89 | ||

| 8 | Outside State | 360 | 89.46 | 4.96 | 94.42 | 118.59 | -24.17 | ||

| 9 | AP | 7000 | 214 | 1498.00 | 96.41 | 1594.41 | 2305.94 | -711.53 | |

| Total | 24686 | 7594.63 | 200.66 | 340.00 | 8135.29 | 8132.06 | 893.70 890.48 |

This means that Rs.893.70 crores cross subsidy is generated at revised level of tariff against which Rs.890.48 crores cross subsidy is utilized leaving a marginal surplus of Rs.3.22 crores only.

Utilizing the figures of aggregate quantum of cross subsidy in each consumer category under the existing and the revised tariffs as worked out in Tables 9.3 and 9.4 above, we get the gross quantum of cross subsidy from each category for the year 2004-05 and for the year 2005-06 after the tariff revision through this Order.

| Sr. No. | Category | Quantum of Cross Subsidy in absolute terms | |||

|---|---|---|---|---|---|

| Existing for the year 2004-05 | Revised for the year 2005-06 | ||||

| Energy SaleMUs | Cross SubsidyRs. Crores | Energy SaleMUs | Cross SubsidyRs. Crores | ||

| 1 | 2 | 3 | 4 | 5 | 6 |

| 1 | Domestic | ||||

| a) | Upto 100 | 2833 | -228.99 | 3040 | -274.33 |

| b) | 101-300 | 1287 | 68.43 | 1382 | 78.44 |

| c) | >300 units | 1030 | 74.33 | 1106 | 85.99 |

| Total | 5150 | -86.21 | 5528 | -109.89 | |

| 2 | NRS | 1306 | 169.55 | 1444 | 199.58 |

| 3 | Public Lighting | 111 | 10.97 | 123 | 13.2 |

| 4 | Industrial | ||||

| a) | SP | 703 | 26.23 | 707 | 27.84 |

| b) | MS | 1447 | 88.74 | 1581 | 104.17 |

| c) | LS | 6979 | 462.07 | 6979 | 495.57 |

| Total | 9129 | 577.05 | 9267 | 627.56 | |

| 5 | Bulk Supply | 437 | 32.91 | 460 | 37.7 |

| 6 | Rly. Traction | 117 | 13.68 | 123 | 15.66 |

| 7 | Common Pool | 381 | -33.26 | 381 | -44.89 |

| 8 | Outside State | 360 | -13.18 | 360 | -24.17 |

| 9 | AP | 6563 | -598.00 | 7000 | -711.53 |

| Total | 23554 | 804.16 -730.65 | 24686 | 893.70 -890.48 | |

It is seen from the Table that the aggregate quantum of cross subsidy for overall Domestic Sector has been reduced from Rs.86 + 65 crores to Rs.110 crores while the same has increased for other categories.

As already explained above, cross subsidy is defined by the Commission as the difference between the revenue actually realized from a particular category and combined average cost of supply expressed as a percentage of combined average cost of supply. The cross subsidy levels with the existing tariff and the revised tariff now approved by the Commission are given in Table 9.6.

| Sr.No. | Category | Existing TariffCombined Average cost of supply = 299.17 paise/unit | Revised TariffCombined Average cost of supply = 329.42 paise/unit | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Energy Sales (MU) | Total Revenue (Rs. Crores) | Realisation per unit Ps/unit | Cross Subsidy%age | Energy Sales (MU) | Total Revenue (Rs. Crores) | Realisation per unit Ps/unit | Cross Subsidy%age | ||

| 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 |

| 1 | Domestic | ||||||||

| a) | Upto 100 | 2833 | 618.56 | 218.34 | -27 | 3040 | 727.11 | 239.18 | -27.4 |

| b) | 101-300 | 1287 | 453.46 | 352.34 | 17.8 | 1382 | 533.7 | 386.18 | 17.2 |

| c) | >300 units | 1030 | 382.48 | 371.34 | 24.1 | 1106 | 450.33 | 407.17 | 23.6 |

| Total | 5150 | 1454.52 | 282.43 | -5.6 | 5528 | 1711.14 | 309.54 | -6 | |

| 2 | NRS | 1306 | 560.27 | 429 | 43.4 | 1444 | 675.26 | 467.63 | 42 |

| 3 | Public Lighting | 111 | 44.18 | 398.02 | 33 | 123 | 53.72 | 436.75 | 32.6 |

| 4 | Industrial | ||||||||

| a) | SP | 703 | 236.55 | 336.49 | 12.5 | 707 | 60.74 | 368.8 | 12 |

| b) | MS | 1447 | 521.64 | 360.5 | 20.5 | 1581 | 624.98 | 395.31 | 20 |

| c) | LS | 6979 | 2549.98 | 365.38 | 22.1 | 6979 | 2794.59 | 400.43 | 21.6 |

| Total | 9129 | 3308.17 | 362.38 | 21.1 | 9267 | 3680.3 | 397.14 | 20.6 | |

| 5 | Bulk Supply | 437 | 163.65 | 374.49 | 25.2 | 460 | 189.23 | 411.37 | 24.9 |

| 6 | Rly. Traction | 117 | 48.68 | 416.07 | 39.1 | 123 | 56.18 | 456.75 | 38.7 |

| 7 | Common Pool | 381 | 80.72 | 211.86 | -29.2 | 381 | 80.62 | 211.6 | -35.8 |

| 8 | Outside State | 360 | 4.52 | 262.56 | -12.2 | 360 | 94.42 | 262.28 | -20.4 |

| 9 | AP | 6563 | 1365.45 | 208.05 | -30.5 | 7000 | 1594.41 | 227.77 | -30.9 |

| Total | 23554 | 7120.16 | 302.29 | 1 | 24686 | 8135.29 | 329.55 | 0 |

Note: The revenue realized at existing level does not take into account the effect of Rural Domestic concession (Rs.65 crores).

It will be seen from the Table above that there are only insignificant changes in the existing level of cross subsidies.

The Commission had approved the annualization of tariff for the year 2002-03 in its Tariff Order dated September 6, 2002. It had at that time also decided that as a matter of policy, the Commission would not allow the benefit of annualization in the event of Board failing to file the ARR and Tariff Application in time thereby resulting in delay in passing of the Tariff Order by the Commission. For the current year, though the Board filed the ARR & Tariff Application on December 30, 2004, the same was not found to be complete and deficiencies noted therein were communicated to the Board vide Commission's letter No.260/PSERC dated January 21, 2005. After completion of the deficiencies, the ARR and Tariff Revision Application of the Board were taken on record only on February 9, 2005 thereby delaying the issuance of the Tariff Order by the Commission. The Commission, however, appreciates that in case the annualization of tariff is not effected and the Tariff Order is also made effective from a prospective date, the Board shall not be able to recover the enhanced legitimate costs incurred by it. This, in turn, will put the Board to substantial financial loss which is not a very healthy situation. The Commission further notes that in case tariff is made effective from April 01, 2005, the revised tariff is applicable only for the consumption of energy made after that date and as such the bills for this period may generally not have been issued to the consumers. Even in cases where the bills stand issued, the consumers shall not be at a great dis-advantage if the arrear bills are issued which can be paid by consumers at one-go as these bills will generally cover the consumption of not more than a month. The Commission, therefore, decides to make the revised Tariff applicable from April 01, 2005. Such a course of action will ensure complete recovery of the legitimate costs incurred by the Board for supply of power and at the same time, not affect consumers' interest adversely.

| D.O.No.PS/116 Dated: May 19 , 2005 |

| AJANTA DAYALAN, IAAS Secretary | Punjab State Electricity Regulatory Commission SCO 220-221, Sector 34-A, Chandigarh - 160022.Tel - 0172-2648321, Fax – 0172-2664758 |

As you are aware, Punjab State Electricity Board has filed its Annual Revenue Requirement and Tariff Application for the year 2005-06 with the Commission. This filing includes the revised Annual Revenue Requirement for the year 2004-05 as well as truing up for the year 2003-04. A copy of the filing of the Board was forwarded to the State Government for its comments. The same have since been received. The Commission has now finalized its order on the Annual Revenue Requirement and the tariff proposal sent by the Board after following the prescribed procedure and completing all the required formalities. Before making the Tariff Order public, the State Government is hereby approached to indicate its views regarding its plan to extend subsidy to any consumer or class of consumers under Section 65 of the Electricity Act, 2003.

In the past, the State Government has been subsidizing the Agricultural Pumpset consumers and small section of domestic consumers belonging to Scheduled Castes. During the year 2004-05, the State Government had committed a total subsidy of Rs.902.56 crores, out of which Rs.852.56 crores were meant for Agricultural Pumpset consumers and Rs.50 crores were meant for domestic SC category consumers having load of 300 watt or less for supply upto 50 units per month. The subsidy was to consist of the following components:

Interest on Government loans amounting to Rs.459.68 crores;

Balance subsidy of Rs.442.88 crores to be made available through retention of Electricity Duty and in case of short-fall, the Government was required to pay the same in cash.

For determination of the Annual Revenue Requirement for the year 2005-06, the Commission has followed the practice of the last year and has taken into consideration the out come of the truing up exercise for the year 2003-04 based on audited balance-sheet figures now available and fresh determination of gap for the year 2004-05 based on revised figures now made available to the Commission by the Board. Combining the result of all the three exercises, the total revenue gap has been worked out at Rs.768.65 crores. This includes gap of Rs.268.58 crores for the year 2003-04 and 2004-05 and Rs.500.07 crores for the year 2005-06. The average cost of supply for the year 2005-06 comes to 318.54 paise per unit as against the cost of supply of 310.13 paise per unit for the year 2004-05 as determined in the Tariff Order 2004-05 However, this average cost of supply does not take into consideration the additional liabilities now worked out for the years 2003-04 and 2004-05 and as such, does not represent a complete picture. The tariff hikes during the current year will involve recovery of enhanced cost not only for the current year but for the past two years as well. Accordingly, the total gap of Rs.768.65 crores will need to be recovered during the current year itself to compensate the Board for the enhanced costs in the preceding years as well as the current year.

To cover this gap, the Commission has decided to enhance the energy charges suitably. The Commission also notes that in Punjab, except for agricultural sector, the cross subsidy levels have already reached the targets being envisaged at the national level to be reached by the year 2010-11. As such, the Commission does not see the need or justification for reducing the cross subsidy levels further during the current year. This is especially so in view of the substantial hikes in tariff necessitated by the total gap of Rs.768.65 crores determined by the Commission. Any further reduction in cross subsidy levels would have entailed still higher tariff hikes in the subsidized categories affecting their interests adversely. Taking into consideration the above and the provisions of the Act for determining tariff, the Commission has decided to adopt a policy of uniform tariff increase across the board for all categories of consumers. The Commission has also decided to increase the Monthly Minimum Charges proportionately to maintain their equivalence with reference to the quantum of energy ensured through these charges. .

Keeping in view the above principles, the Commission has decided the following tariff for the categories of consumers presently being subsidized by the Government:

| Category | Sales level decided by the Commission(MUs.) | Existing tariff rates( paise/unit) | Tariff rates proposed by the Board (paise/unit) | Tariff rates decided by the Commission (paise/unit) |

|---|---|---|---|---|

| 1.Domestic | ||||

| (a) Upto 100 units | 3040 | 200 | 0-30 units 200 31-100 units 230 | 221 |

| (b) 101 to 300 units | 1382 | 334 | Above 100 units 353 | 368 |

| (c) More than 300 units | 1106 | 353 | 389 | |

| 2. AP Pumpset Consumers | 7000 | (i)Without Govt. subsidy 194 Ps/kwh or Rs.205/ BHP/month (ii)With Govt. Subsidy 57 Ps/kwh or Rs.60/ BHP/ month | Unmetered :monobloc pumpsets: Rs.225/BHP/month Unmetered :submersible pumpsets: Rs.286/BHP/month Metered: 213 Ps/unit. | Unmetered: Rs.208/BHP/month Metered214 Ps/unit |

It may be noted that for domestic sector, the proposal of the Board is based on Two Part Tariff including a fixed charge in addition to energy charges and hence the comparisons are not really valid. Further, the Board has proposed a flat rate of Rs.225 /BHP/month and Rs.286/BHP/month for monobloc and submersible pumpsets respectively and a rate of 213 paise/unit for the metered category of pumpsets against which the Commission has fixed the flat rate at Rs.208/BHP/month and a rate of 214 paise per unit for metered consumers. The equivalence between the flat rate and metered rate has varied substantially during the current year due to substantial increase in connected load under Voluntary Disclosure Scheme though this has not justified equivalent increase in energy consumption.

The Commission would like to know from the Government:

exact amount of subsidy which the Government will be willing to extend to the Board; and

allocation of this quantum of subsidy to any particular consumer class/ classes.

During the year 2004-05, the Government had extended subsidy of Rs.852.56 crores for the Agricultural Sector. This was based on the assessed agricultural consumption of 6213 MUs. It was indicated in the Tariff Order 2004-05 that the Government subsidy shall require to be adjusted with reference to actual consumption of agricultural pumpsets during the year. The Board has now indicated an increase of 858 MW in connected load representing over 24% of the total agricultural load during the year 2004-05 itself as against the increase of only 5% envisaged in the Tariff Order 2004-05. Accordingly, the assessed agricultural consumption for the year 2004-05 has been revised to 6563 MUs. Taking into consideration the prevalent rate of 200 paise per unit for the actual agricultural consumption during the first six months and 194 paise per unit for the actual agricultural consumption during the last six months of the year, the requirement of revenue from the Agricultural Pumpset consumers for the year 2004-05 works out to Rs.1299.27 crores. Of this, only Rs.393 crores is expected to be recovered from the farmers. Accordingly, the subsidy requirement of the Government for agricultural sector for the year 2004-05 has now been re-adjusted to Rs.906.27 crores. Similar adjustment has also been carried out for the year 2003-04 with reference to the finally approved agricultural consumption of 5745 MUs. against the originally approved consumption of 5707 MUs. as well as due to variation in actual revenue received from the farmers. The final impact of this adjustment works out to Rs.14.54 crores for the year 2003-04. Thus, the total impact of adjustments of agricultural subsidy for the previous two years is Rs.68.25 crores.

During the current year, the Government has the following options:

In case the Government desires the agriculture pumpset consumers to pay the same rate of Rs.60 /BHP/month as hithertofore, the total requirement for Government Subsidy will work out to Rs.1065.18 crores as per calculation sheet attached.

In case the Government decides to retain old level of subsidy i.e. Rs.852.56 crores the tariff payable by the farmers shall be Rs.89/BHP/month as indicated in the calculation sheet.

In case the Government proposes to reflect the tariff increase of 10% across the board in the tariffs actually paid by farmers as well, the subsidy requirement of the Government will go down by Rs.43.28 crores with reference to sub para (a) thereby reducing the subsidy requirement to Rs.1021.90 crores only.

These amounts will, however, need to be adjusted with reference to the actual agricultural consumption and the actual revenues collected from the farmers during the year.

In addition to above, in case the Government continues the subsidy for domestic sector also as hithertofore, the total subsidy requirement from the Government shall increase by Rs.50 crores.

Of the total subsidy requirement, Rs.480.73 crores is available for adjustment from the interest due from the Board on Government loans during the year 2005-06. Of this, Rs.68.25 crores will need to be retained by the Board towards adjustment of agricultural consumption on actual basis for the years 2003-04 and 2004-05 as per Para 7 above. As such, Rs.412.48crores will be available for adjustment against subsidy payable for the current year. The balance will need to be made good through other means.

It is requested that the views of the Government in this regard be conveyed to the Commission at the earliest so that Tariff Order of the Commission may be issued within the time frame stipulated in the Electricity Act, 2003.

Yours sincerely,

Sd/-

(Ajanta Dayalan)

Government of Punjab

Department of Power

Chandigarh

Yours sincerely,

(Kusumjit Sidhu)

| Chap-1 | Chap-2 | Chap-3 | Chap-4 | Chap-5 | Chap-6 | Chap-7 | Chap-8 | Chap-9 | Chap-10 |