SCO NO. 220-221, SECTOR-34-A

PETITION NO. 1 OF 2009

IN THE MATTER OF:

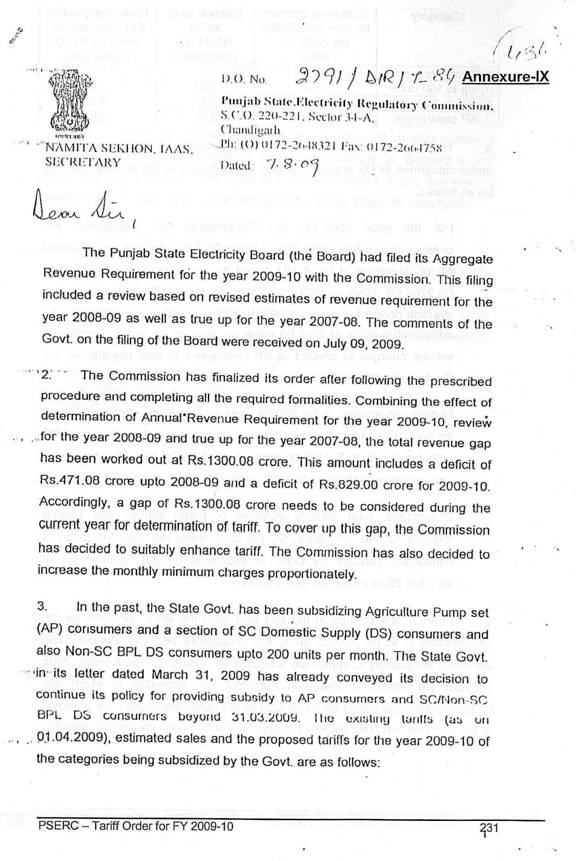

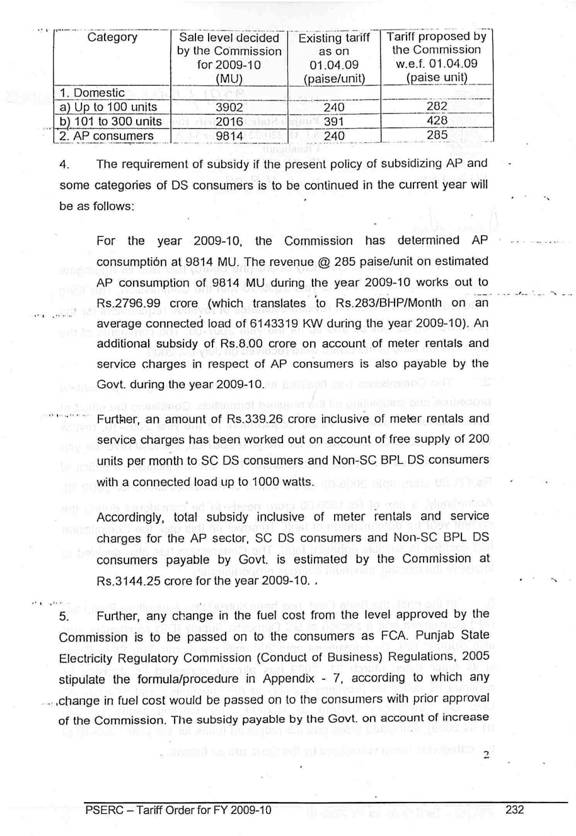

ANNUAL

REVENUE REQUIREMENT

FILED

BY THE

FOR

THE FINANCIAL YEAR 2009-10

PRESENT : Mr.

Jai Singh Gill, Chairman

Ms. Baljit Bains, Member

Mr.

Satpal Singh Pall, Member

Date of Order:

ORDER

The Punjab State

Electricity Regulatory Commission (Commission), in exercise of powers vested in

it under the Electricity Act, 2003 (Act) passes this order determining the

Annual Revenue Requirement (ARR) and Tariff for supply of electricity by the

Punjab State Electricity Board (Board) to consumers of the State of Punjab for

the year 2009-10. The ARR filed by the

Board, facts presented by the Board in its various filings, objections received

by the Commission from consumer organizations and individuals, issues raised by

the public in hearings held at Ludhiana, Bathinda, Jalandhar and Chandigarh,

the responses of the Board to the objections and observations of the Govt.

(Government) in this respect have been considered. The State Advisory Committee

constituted by the Commission under Section 87 of the Act has also been

consulted and all other relevant facts and material on record have been perused

before passing this Order.

1.1

Background

The Commission has in its

previous six Tariff Orders determined tariff in pursuance of the Tariff

Applications and ARRs submitted by the Board for the years 2002-03 to 2006-07 and

2008-09. Tariff Order for the year 2007-08 has been passed by the Commission in

suo motu proceedings.

1.2

ARR

for the year 2009-10

The Board did not file the

ARR and Tariff Application for the year 2009-10 by 30th November,

2008 which is the due date as per PSERC (Terms and Conditions for Determination

of Tariff) Regulations, 2005 (PSERC Tariff Regulations) but filed a petition

(No.24 of 2008) on 2.12.2008 seeking extension of time upto 31.12.2008 in

filing the ARR and Tariff Application which was allowed by the Commission. The

Board filed the ARR for 2009-10 on 29.12.2008. Therein the Board had worked out

a cumulative revenue gap of Rs.6980 crore for the year 2009-10 including

carried over gaps of 2007-08 and 2008-09 but there was no proposal to cover up

the gap depicted in the ARR.

The Government had authorized the

Board under Section 172 of the Act to continue to function as a STU (State

Transmission Utility) and a licensee upto 30.11.2008 and not thereafter, the

Board was asked to clarify this aspect. A reference was also made to the

Government in this respect. The Board in its letter dated 25.2.2009 stated that

the Govt. has on 24.2.2009 authorized it to function as STU and a licensee upto

15.6.2009. Thereupon the Commission took the ARR on record on 27.2.2009. The

Board in its letter dated 19.3.2009 stated that due to inadvertence, cumulative revenue gap for 2007-08, 2008-09

and 2009-10 had been shown as Rs.6980 crore instead of Rs.8546 crore and the

letter was considered as a part of the

ARR. The petition filed by the Board did not contain any proposal to cover this

gap stating that the Commission may determine the gap and fix tariff

accordingly based on the details furnished by it in its ARR. On

scrutiny it was noticed that the ARR was deficient in some respects and in

letter dated 27.3.2009 the Commission sought further information, a part of

which was furnished by the Board in its letters dated 16.4.2009,23.4.2009 and 6.5.2009. The

Board had also filed Petition No.14 of

2008 for review of Tariff Order dated 3.7.2008 passed by the Commission for the

year 2008-09 which the Commission disposed of in its order dated 24.3.2009.

1.3 Invitation

of objections and p

A public notice was

published by the Board in the Tribune, Hindustan Times, Ajit, Jagbani and

Punjab Kesri on

The Commission received 13

written objections by 4.5.2009 and 15 additional written objections thereafter.

The Commission decided to take all these objections into consideration.

Number of objections

received from individual consumers, consumer groups, organizations and others

are detailed below:

|

Sr. No. |

Category |

No. of

Objections |

|

1. |

Chambers of Commerce |

1 |

|

2. |

Industrial Associations |

5 |

|

3 |

Industry |

7 |

|

4 |

Railways |

1 |

|

5 |

PSEB Engineers/Employees Associations |

2 |

|

6 |

Individuals |

8 |

|

7 |

Association of Affiliated Schools |

1 |

|

8 |

Forums |

3 |

|

|

Total |

28 |

The list of objectors is

given in Annexure-I to this Tariff Order. The Board submitted its comments t

The Commission decided to hold

public hearings at

|

Venue |

Date & time of public hearing |

Category

of consumers to be heard. |

|

|

Commission Office i.e. SCO No.220-221, Sector 34-A, |

|

Industry |

|

|

|

Agriculture consumers |

||

|

Commission Office i.e. SCO No.220-221, Sector 34-A, |

|

All consumers except Industry, Agricultural consumers and staff

associations/unions of the Board. |

|

|

|

Staff associations/unions of Board and other organizations. |

||

|

Circuit House, |

|

All consumers/organizations |

|

|

JALANDHAR Circuit House, Skylark Chowk,

Opp. Skylark Hotel, Jalandhar. |

|

All consumers/organizations |

|

|

BATHINDA Circuit House, Civil Lines, Near D.C.Residence, Bathinda. |

|

All consumers/organizations |

|

Through public notices

published in different newspapers, it was intimated that the Commission will

conduct a public hearing at

The public hearings were held as

per schedule, and objectors, general public and the Board were heard by the

Commission. A summary of the issues raised, the

responses of the Board and the views of the Commission are contained in

Annexure-II of this Tariff Order.

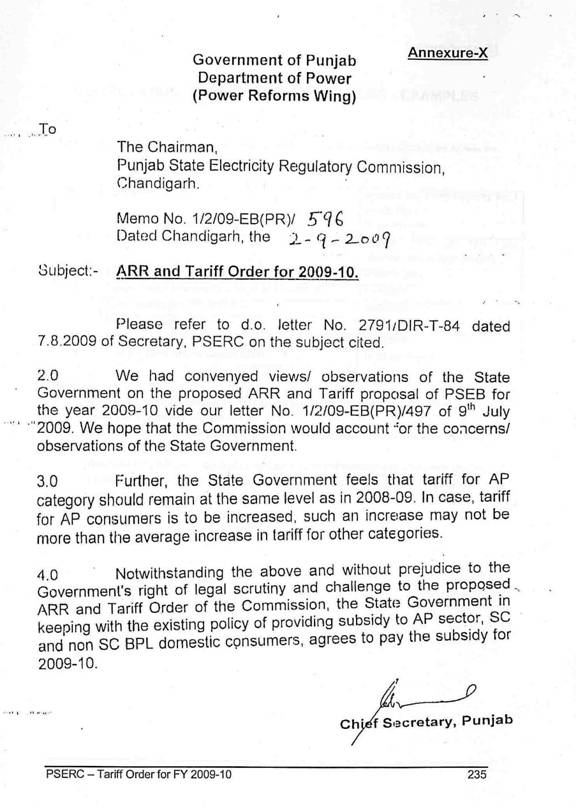

1.4 The Government was approached by the

Commission through a letter dated 8.4.2009 seeking its views on the ARR to

which the Government responded on 9.7.2009, which has been taken note of by the

Commission.

1.5

State Advisory Committee

The State Advisory Committee

set up under Section 87 of the Act, discussed the Board’s ARR in a meeting

convened for the purpose on 09.06.2009. The minutes of the meeting of the State

Advisory Committee are enclosed as Annexure–III to this Order.

The Commission has thus

taken the necessary steps to ensure that the due process, as contemplated under

the Act and Regulations framed by the Commission, is followed and adequate

opportunity given to all stakeholders in presenting their views.

1.6

Compliance

of Directives

In its previous Tariff

Orders, the Commission had issued certain directives to the Board in the public

interest. A summary of directives issued along with the comments of the

Commission is given in Annexure-IV of this Tariff Order.

Chapter 2

True-up for the year 2007-08

2.1

Background

2.1.1 The Commission

approved the ARR and Tariff for the year 2007-08 in its suo motu Tariff Order

dated September 17, 2007 which was based on the

information/data provided by the Board. The Board had furnished revised

estimates for that year during the determination of ARR and Tariff for 2008-09

in which there were major differences in certain items of costs as well as

projected revenues both in the revised estimates furnished by the Board and the

approvals granted by the Commission. The Commission in its Tariff Order of

2008-09 reviewed its earlier approvals and re-determined the same based on the

revised estimates made available. The Board has now furnished the audited

accounts for the year 2007-08 which again vary in parts with the figures taken

into account in the review of 2007-08 by the Commission. This chapter contains

a final true up of 2007-08, based on the Audited Annual Statement of Accounts

(audited accounts) but without altering the principles and the norms approved

earlier.

2.2

Energy Demand (Sales)

2.2.1 The sales projected by the Board during the suo motu determination of ARR for 2007-08, sales approved by the Commission in the Tariff Order of 2007-08, revised estimates furnished during determination of ARR of 2008-09, sales approved by the Commission in review and actual sales figures now given by the Board are given in Table 2.1.

Table 2.1: Energy Sales – 2007-08

(MU)

|

Sr. No. |

Category |

Projected

by PSEB during suo motu determination of ARR 07-08 |

Approved by the

Commission in T.O. 07-08 |

Revised Estimates of PSEB

during determination of ARR of 08-09 |

Approved by the

Commission in review |

Actuals as in the ARR of 09-10 |

Now approved by the Commission |

|

1 |

2 |

3 |

4 |

5 |

6 |

7 |

8 |

|

1 |

Domestic |

5897 |

5926 |

6302 |

6273 |

6491 |

6491 |

|

2 |

Non-Residential |

1774 |

1748 |

1877 |

1876 |

1919 |

1919 |

|

3 |

Small Power |

712 |

655 |

736 |

732 |

738 |

738 |

|

4 |

Medium Supply |

1560 |

1649 |

1568 |

1564 |

1579 |

1579 |

|

5 |

Large Supply |

8522 |

8412 |

8877 |

8825 |

8733 |

8733 |

|

6 |

Public Lighting |

145 |

143 |

141 |

139 |

140 |

140 |

|

7 |

Bulk

Supply & Railway Traction |

603 |

630 |

585 |

583 |

614 |

614 |

|

8 |

Total Metered sales (within State) |

19213 |

19163 |

20085 |

19992 |

20214 |

20214 |

|

9 |

Agriculture pumpsets |

8939 |

8645 |

9537 |

8960 |

10030 |

8902 |

|

10 |

Total sales within the State

|

28152 |

27808 |

29622 |

28952 |

30244 |

29116 |

|

11 |

Common pool |

300 |

300 |

303 |

303 |

302 |

303 |

|

12 |

Outside State sales |

952 |

827 |

1615 |

1615 |

1576 |

1576 |

|

13 |

Total

(10+11+12) |

29404 |

28935 |

31540 |

30870 |

32122 |

30995 |

The Board has furnished the

actual total sales at 32122 MU for the year 2007-08 as per audited accounts

including the theft of energy of 208 MU. This theft of energy has not been

apportioned to different consumer categories in the audited accounts but the

Board in its ARR petition (Vol. 1) for the year 2009-10 has submitted

category-wise sales for 2007-08 including theft of energy which is as per

column 7 of Table 2.1.

2.2.2

Metered

Sales: In metered sales, the Board has included 208 MU of energy on account

of theft. The revenue on this account has been shown as Rs.27.98 crore in the

annual accounts which is not commensurate with the revenue accruing from sale of energy of 208 MU to

metered categories. Owing to this discrepancy in figures and in the absence of any

proper justification forthcoming from the Board, the Commission had been

following the approach of re-estimating energy on account of theft by matching

it with the revenue shown therefrom. Now, the Board in its letter of 06.05.2009

has submitted that as per accounting procedures, the amount assessed under

theft and the amount assessed under sale of power are required to be booked

under different account heads. It is noticed, however, that the theft amount is

sometimes credited as sale of power (SOP), whereas consumption is accounted for

as theft of energy which results in lower realization on this account being

reflected in

The Commission accepts common pool sales at 303 MU and outside state sales as 1576 MU on the basis of actuals as given in the audited accounts for 2007-08.

Metered sales now approved

by the Commission are as shown in column 8 of Table 2.1.

2.2.3

AP Consumption: The

Commission in its tariff order of 2007-08 approved AP consumption of 8645 MU

after allowing a normative growth of 5% over the revised approved consumption

of 8233 MU for the previous year (2006-07). While doing so, the Commission

observed that the methodology of computing AP consumption on the basis of

sample meter readings and connected load needs further refinement. The Board in

its ARR for 2008-09, reported a revised AP consumption of 10012 MU in 2007-08

against an average connected load of 5351380 KW. The increase was explained to

be on account of deficient rainfall in the kharif season, increased load owing

to regularization of connected load under Voluntary Disclosure Schemes (VDS)

launched during 2006-07 and 2007-08 and the increasing use of submersible

pumps. The Commission in its Tariff Order for the year 2008-09 observed that

the assessment of AP consumption is based on the calculation of AP consumption

factor which is worked out from sample meter readings and the connected load of

pumps on which these meters are installed. The Commission had noted that the

verified actual connected load of the pump sets on which sample meters have

been installed was not available and there were several inconsistencies in

reporting connected load on account of VDS and release of new connections. For the

reasons discussed in that Tariff Order, the Commission was not convinced of the

correctness of the revised AP consumption for 2007-08 reported as 10012 MU. In

the circumstances the Commission decided to revise the estimate of AP

consumption in 2007-08 by applying an increase in connected load of 8.81% to AP

consumption of 8235 MU determined for the year 2006-07. Accordingly, estimate

of AP consumption for the year 2007-08 was revised to 8960 MU. The Board has

now submitted the AP consumption for 2007-08 as 10030 MU as per audited

accounts.

During the course of

hearings of the ARR and Tariff Petition for the year 2008-09, the Board offered

that in case the present method of assessing AP consumption is not acceptable,

the Commission may appoint an independent agency for reassessing the same, the

full cost of which will be borne by the Board. The Commission thereupon decided

to undertake a study on the subject.

The Commission appointed

M/s ABPS Infrastructure Advisory Private Limited, Mumbai (Agency) for

validation of AP consumption reported by the Board for the year 2007-08 and

first three quarters of 2008-09. As per the terms of reference of the work

assigned to the Agency, it was to collect the details of connected load and the

recorded consumption of the sample meters for 2007-08 and the first three

quarters of 2008-09 in respect of five circles i.e. Sangrur, Khanna,

Hoshiarpur, Gurdaspur and Bathinda. One circle in each zone was selected with a

view to make the sample of the study as representative as possible of the

various regions of the State. The figures so obtained were then to be validated

after comparing it with the records maintained in the field.

The Agency following the

methodology adopted by the Board did not take into account the sample meters

falling under the following categories:

· Defective Meters

· Locked Meters

· Meters with initial readings and Meters with zero readings

·

Meters with abnormal readings/inconsistent

readings

The Agency collected the

details of connected load, supply hours and the consumption of sample meter

connections from the Board’s System Losses Study Cell (SLSC) in respect of all

the five circles. It also observed that consumption shown by some of the

sample meters was more than it possibly could have been with the supply hours

intimated by SLSC. This sample meter load was thereafter validated by

the Agency from the AP ledgers/VDS registers maintained at the Sub Divisional

offices of the Board. The Agency observed that the load of some of the sample

meters was not updated inspite of actual enhancement under VDS or otherwise.

The circle wise percentage increase in the actual load was observed as under: -

Khanna 4.9

Bathinda 4.7

Sangrur 3.8

Gurdaspur 1.5

Hoshiarpur 2.5

After updating the loads of

sample meters and recalculating the consumption of those meters which showed

consumption inconsistent with the reported loads and given supply hours, the

Agency calculated the month wise AP factor of each division for all the five

circles and thereafter computed the monthly consumption of each division by

multiplying the AP factor thus arrived at with the total connected load of the

division.

The Agency submitted its

report in May 2009. The AP consumption worked out by the Agency in the five

circles with the AP factor of the Board, the AP consumption determined with AP

factor calculated with updated loads and the difference in percentage terms is

given in Table 2.1(A).

Table 2.1(A)

|

Circles |

Consumption as per PSEB AP factor (MU) |

Consumption as per AP factor computed by

the Agency (MU) |

% difference |

|

Khanna |

509.94 |

399.39 |

21.68 |

|

Bathinda |

479.52 |

356.13 |

25.73 |

|

Sangrur |

1543.80 |

1188.31 |

23.03 |

|

Gurdaspur |

486.20 |

366.62 |

24.59 |

|

Hoshiarpur |

386.87 |

307.83 |

20.43 |

A copy of the preliminary

report submitted by the Agency to the Commission was sent to the Board for its

comments. The Board made the following observations:

·

Average AP connected load is not

as per PSEB records.

·

Light load has not been considered

at a number of places.

·

The supply hours considered in the

study are not as per actuals.

·

The efficiency of the motors has

not been taken into account.

·

Possibility of unauthorized loads

not being accounted for.

In view of these observations, the Agency was asked to recalculate the AP consumption for all the five circles. The Agency has, by and large, accepted the Board’s contentions as mentioned above and considered supply hours data provided by the office of the Chief Engineer/SO&C, factored in the efficiency of motors and also had taken into account the lighting load while computing the total load of the division. The possibility of unauthorized loads could not be taken into account because of difficulties in its quantification. The Agency then recalculated the AP factor with updated load on sample meters and consumption earlier supplied by the Board excluding the excessive consumption recorded by sample meters to the extent it was incompatible with the revised figures of connected load and supply hours. The connected load of each Division as furnished by the Board and AP factor arrived at as above was considered to calculate the total consumption in each Division of the five circles. The Agency submitted its report giving circle-wise consumption for 2007-08 which is compared with the AP consumption earlier supplied by the Board as in Table 2.1(B).

Table 2.1(B)

|

Circle |

AP

consumption for 2007-08 (MU) |

% difference |

|

|

Supplied

by Board |

Computed by the

Agency |

||

|

Khanna |

513.05 |

452.2 |

11.86 |

|

Bathinda |

497.463 |

416.0 |

16.38 |

|

Sangrur |

1592.764 |

1452.0 |

8.84 |

|

Gurdaspur |

489.608 |

435.0 |

11.15 |

|

Hoshiarpur |

381.022 |

328.0 |

13.92 |

|

Total |

3473.907 |

3083.2 |

11.25 |

Based on the validation of data for the five circles, a variation of 11.25% is observed between AP consumption reported by the Board to the Commission and that computed by the Agency. It is evident that the difference is mainly on account of non-updation of loads of AP connections on which sample meters have been installed and excessive consumption shown in the recordings of sample meters that is inconsistent with the given supply hours and the connected load. The report of the Agency is based primarily on the data furnished by the Board which has also been validated from the Board’s records. Moreover, the observations of the Board to the preliminary report made available to them have also, by and large, been taken into account. For these reasons, the Commission has no hesitation in accepting the findings of the Agency.

As the sample in the study represents 25% of the circles and about 33% of the total estimated AP consumption, its findings can with some measure of assurance be applied to the rest of the State. The Commission, accordingly, finds sufficient reason to presume that a similar pattern of over reporting agricultural consumption prevails in other circles of the Board as well. Accordingly, the Commission decides to reduce agriculture consumption reported by the Board (10030 MU) by 11.25% by applying the findings of this study to the State as a whole.

The Commission thus approves AP consumption of 8902 MU based on the

validated data and report of the Agency for the year 2007-08.

2.3

Transmission and Distribution Losses (T&D

Losses)

2.3.1

The Commission in its Tariff Order of 2007-08

fixed the target of T&D losses at 19.50%. During the determination of ARR

of 2008-09, the Board stated that T&D losses in 2007-08 would be 22.70% but

the Commission retained the T&D losses at 19.50% in the review. The Board

has now intimated that the actual losses of 2007-08 are 22.53%. The Commission,

however, sees no reason to accept T&D losses in excess of the target fixed

by the Commission.

The Commission, therefore, retains the T&D losses at 19.50% as

approved in the Tariff Order for the year 2007-08.

2.4 PSEB’S Own Generation

2.4.1 Thermal Generation: The station-wise generation projected by the Board during the suo motu determination of ARR by the Commission for the year 2007-08, generation approved by the Commission in the Tariff Order, revised estimates furnished by the Board during determination of ARR of 2008-09, generation approved by the Commission in the review, actuals now supplied by the Board with the ARR for 2009-10 and generation finally approved by the Commission is given in Table 2.2.

Table

2.2: Thermal Generation – 2007-08

(MU)

|

Sr.

No. |

Station |

Projected by PSEB during suo motu

determination of ARR 07-08 |

Approved

by the Commission T.O. 07-08 |

Revised

Estimates by PSEB in ARR 08-09 |

Approved

by the Commission T.O. 08-09 |

Actuals

by PSEB submitted in ARR 09-10 |

Now

approved by the Commission |

||||||

|

Gross |

Net |

Gross |

Net |

Gross |

Net |

Gross |

Net |

Gross |

Net |

Gross |

Net

|

||

|

1 |

2 |

3 |

4 |

5 |

6 |

7 |

8 |

9 |

10 |

11 |

12 |

13 |

14 |

|

1 |

GNDTP |

2540 |

2248 |

2769 |

2464 |

2885 |

2549 |

3008 |

2677 |

3008* |

2663 |

3008 |

2677 |

|

2 |

GGSTP |

9200 |

8418 |

9510 |

8702 |

9356 |

8553 |

9806 |

8972 |

9806 |

8979 |

9806 |

8972 |

|

3 |

GHTP

Stage-1 |

4500 |

4095 |

3542 |

3223 |

3418 |

3110 |

3509 |

3193 |

3508 |

3197 |

3508 |

3192 |

|

4 |

GHTP

Stage-2** |

|

|

|

|

|

|

|

|

135 |

120 |

135 |

123 |

|

5 |

Total |

16240 |

14761 |

15821 |

14389 |

15659 |

14212 |

16323 |

14842 |

16457 |

14959 |

16457 |

14964 |

* Includes 44 MU generated

during trial run of GNDTP Unit-1 during April 2007 after the R&M works were

completed, as intimated by the Board in its letter no. 601 dated 16.4.2009.

** Energy generated during trial run.

Plant-wise generation is not available in the annual statement of accounts and as such the data supplied along with the ARR of 2009-10 and the generation figures validated by the Commission have been taken into account.

Accordingly, the Commission approves gross thermal generation for the year 2007-08 at 16457 MU.

Auxiliary Consumption

The auxiliary consumption projected by the Board during suo motu determination of ARR by the Commission for the year 2007-08, auxiliary consumption approved by the Commission in the Tariff Order, revised estimates furnished during determination of ARR of 2008-09, auxiliary consumption approved by the Commission in the review, actuals now supplied by the Board with the ARR for 2009-10 and auxiliary consumption finally approved by the Commission is given in Table 2.3 below.

Table

2.3: Auxiliary Consumption – 2007-08

|

Sr. No. |

Station |

Projected by PSEB during suo motu determination of

ARR 07-08 |

Approved by the

Commission in T.O. 07-08 |

Revised Estimates by PSEB in

ARR 08-09 |

Approved by the Commission in

T.O. 08-09 |

Actuals by PSEB submitted in ARR 09-10 |

Now approved by the

Commission |

|

1 |

2 |

3 |

4 |

5 |

6 |

7 |

8 |

|

1 |

GNDTP |

11.50% |

11% |

11.63% |

11% |

11.41% |

11.00% |

|

2 |

GGSTP |

8.50% |

8.50% |

8.58% |

8.50% |

8.44% |

8.50% |

|

3 |

GHTP |

9% |

9% |

9.01% |

9% |

8.87% |

9.00% |

It is observed that actual

auxiliary consumption now reported by the Board is marginally higher for GNDTP

and lower for GGSTP and GHTP than the approved levels. As auxiliary consumption has been approved on normative basis, the

Commission is inclined to retain the levels as approved in the Tariff Order for

2007-08.

The net

thermal generation on this basis works out to 14964 MU as shown in column 14 of

Table 2.2.

The Commission further

observes that the Board has over-achieved in thermal generation by 501 MU (16322*

- 15821) gross and 452 MU (14841**-14389) net as compared to generation

originally approved, as shown in Table 2.2.

* 16322 = 16457 - 135

** 14841

= 14964 - 123

The Commission takes note

of higher thermal generation and consequential less power purchase to that

extent. This is further

discussed in para 2.9.

2.4.2 Hydel Generation: The station-wise generation submitted by the Board to the Commission during suo motu determination of ARR and Tariff for the year 2007-08, generation approved by the Commission in its Tariff Order, revised estimates furnished by the Board during determination of ARR of 2008-09, generation approved by the Commission in review and actuals now furnished by the Board and those accepted by the Commission are given in Table 2.4.

Table 2.4:

Hydel Generation – 2007-08

(MU)

|

Sr. No. |

Hydel Station |

Projected by PSEB during

suo motu determination of ARR

07-08 |

Approved by Commission in TO 07-08 |

RE by PSEB in ARR 08-09 |

RE accepted by Commission in TO 08-09 |

Actuals by PSEB in ARR 09-10 |

Now approved by Commission |

|

1 |

2 |

3 |

4 |

5 |

6 |

7 |

8 |

|

1 |

Shanan |

529 |

529 |

517 |

540 |

540 |

540 |

|

2 |

UBDC |

446 |

446 |

380 |

428 |

428 |

428 |

|

3 |

RSD |

1568 |

1568 |

1484 |

1539 |

1538 |

1538 |

|

4 |

MHP |

1026 |

1026 |

1399 |

1362 |

1362 |

1362 |

|

5 |

ASHP |

657 |

642 |

790 |

710 |

710 |

710 |

|

6 |

Micro Hydel |

7 |

7 |

8 |

7 |

7 |

7 |

|

7 |

Total own hydel |

||||||

|

a |

Gross |

4233 |

4218 |

4578 |

4586 |

4585 |

4585 |

|

b |

Net |

4203 |

4059 |

4404 |

4425 |

45271 |

43653 |

|

8 |

PSEB Share from BBMB |

|

|

|

|

|

|

|

a |

Gross Share |

4204 |

4204 |

4653 |

4325 |

4327 |

4327 |

|

b |

Add Common pool share |

300 |

300 |

303 |

303 |

302 |

303 |

|

c |

Less External losses |

161 |

146 |

183 |

168 |

171 |

171 |

|

d |

Net Share from BBMB |

4343 |

4358 |

4773 |

4460 |

44582 |

4459 |

|

9 |

Total Net Hydel (Own + BBMB) |

8546 |

8417 |

9177 |

8885 |

8985 |

8824 |

1.

Net of auxiliary consumption (8 MU) and

transformation loss (50 MU).

2.

BBMB share including common pool is net of

transmission loss of 171 MU (3.95%) of gross share not including common pool.

3.

Own generation is net of

·

HP share (free) in RSD @ 4.6% (71 MU),

·

Royalty to HP in Shanan (53 MU),

·

Diversion to BBMB from ASHP (59 MU) on account of

extra power generated because of diversion of water from Nangal Hydel Channel

to Anandpur Sahib Hydel Channel during repair at Ganguwal/Kotla power houses,

·

Transformation loss @ 0.5% (23 MU)

·

Auxiliary consumption @ 0.5% for RSD generation of

1538 MU and UBDC Stage-1 generation of 184 MU (having static exciters) and @ 0.2%

for others (14 MU).

The actual gross hydel

generation from the Board’s own hydel stations for the year 2007-08 is 4585 MU

and the Commission accepts the same. While calculating the net generation, the

Board has not deducted the free HP share in RSD and royalty in Shanan. In line

with the principle being followed in such sales, the Commission has worked out

net hydel generation by deducting HP share in RSD, royalty in Shanan and

diversion to BBMB from ASHP from gross generation along with the auxiliary

consumption and transformation losses. Net hydel generation for the year

2007-08 thus works out to 4365 MU. The actual net availability from BBMB is

4459 MU which the Commission accepts.

The Commission, therefore, approves net

hydel generation for the year 2007-08 at 4365 MU from the Board’s own

generation and 4459 MU as net share from BBMB as shown in table 2.4.

2.5

Power Purchase

2.5.1 The Commission in its Tariff Order of 2007-08 approved net power purchase of 12865 MU. During determination of ARR of 2008-09, the Board furnished revised estimates for net power purchase of 16850 MU but in review, the Commission approved 14156 MU only. The Board has now submitted net purchases during 2007-08 of 16974 MU as per audited accounts. This matter is further discussed in para 2.8.

2.6

Energy Balance

2.6.1

The details of energy requirement and availability approved

by the Commission in review in the Tariff Order of 2008-09 and the actuals now

furnished by the Board are given in Table 2.5. The energy balance, including

T&D losses along with sales and availability now approved by the Commission

is depicted in column 6 of Table 2.5.

Table 2.5: Energy

Balance – 2007-08

(MU)

|

Sr.

No. |

Particulars |

Approved

by the Commission in T.O. 08-09 |

Actual

by PSEB in ARR 09-10 |

Now

approved by the Commission |

Sales

& actual T&D losses as per approved

availability |

|

1 |

2 |

3 |

4 |

5 |

6 |

|

A)

Energy Requirement |

|||||

|

1 |

Metered

Sales |

19,992 |

20,214 |

20,214 |

20,214 |

|

2 |

Sales

to Agriculture Pumpsets |

8,960 |

10,030 |

8,902

|

8,902

|

|

3 |

Total

Sales within the State |

28,952 |

30,244 |

29,116

|

29,116

|

|

4 |

Loss

percentage |

19.50%

|

22.53% |

19.50%

|

25.12%

|

|

5 |

T&D

losses |

7,013 |

8,796 |

7,053

|

9,767

|

|

6 |

Sales

to Common pool consumers |

303 |

302 |

303 |

303 |

|

7 |

Outside

State Sales |

1,615 |

1,576 |

1,576 |

1,576 |

|

8 |

Total

requirement |

37,883 |

40,918 |

38,048

|

40,762

|

|

B)

Energy Available |

|||||

|

9 |

Own

generation (Ex-bus) |

||||

|

10 |

Thermal |

14,842 |

14,959 |

14,964

|

14,964

|

|

11 |

Hydro |

4,425 |

4,527 |

4,365 |

4,365 |

|

12 |

Share

from BBMB (incl.share of common pool consumers |

4,460 |

4,458 |

4,459

|

4,459

|

|

(common pool = 303) |

(common pool = 302) |

(common pool = 303) |

(common pool = 303) |

||

|

13 |

Purchase

net |

14,156 |

16,974 |

16,974 |

16,974

|

|

14 |

Total

Available |

37,883 |

40,918 |

40,762

|

40,762

|

2.6.2

The total energy requirement now approved by the

Commission considering T&D losses at 19.50% is 38048 MU (net) as against 40918

MU projected by the Board, whereas total energy availability now approved is 40762

MU (net). The difference of 2714 MU (net) between energy requirement and energy

availability is owing to the underachievement of T&D loss target as

discussed in para 2.3 and depicted in columns 5 & 6 of Table 2.5. Higher

T&D loss over and above the level approved by the Commission has resulted

in increased net power purchase to the extent of 2714 MU (9767 - 7053) MU. The

matter is further discussed in para 2.9.

The Commission

approves the total energy requirement for the year 2007-08 at 38048 MU (net)

after retaining T&D losses at 19.50%.

2.7

Fuel Cost

2.7.1

In its Tariff Order of 2007-08, the Commission approved the

fuel cost as Rs.2404.28 crore for a gross thermal generation of 15821 MU. In

review, this cost was revised to Rs.2484.00 crore for the then approved

generation of 16323 MU. Details of approved fuel cost in the Tariff Order of

2007-08 and review are given in Table 2.6.

Table 2.6: Fuel Cost – 2007-08

|

Sr. No. |

Station |

As per T.O. 07-08 |

As per Review in T.O.

08-09 |

||

|

Gross Generation (MU) |

Fuel Cost (Rs.crore) |

Gross Generation (MU) |

Fuel Cost (Rs.crore) |

||

|

1 |

2 |

3 |

4 |

5 |

6 |

|

1 |

GNDTP |

2769 |

474.16 |

3008 |

513.90 |

|

2 |

GGSTP |

9510 |

1416.83 |

9806 |

1,467.20 |

|

3 |

GHTP |

3542 |

513.28 |

3509 |

502.90 |

|

4 |

Total |

15821 |

2404.28 |

16323 |

2,484.00 |

2.7.2 The Board in its ARR of 2009-10 has indicated actual fuel cost for 2007-08 for a gross generation of 16322 MU as Rs.2626 crore whereas in the audited accounts of 2007-08, the total generation expenses are Rs.2645.56 crore. These comprise of Rs. 2535.22 crore for coal and oil consumption, Rs.15.61 crore for other fuel related costs including octroi, contract handling charges, siding charges etc., Rs.74.97 crore for fuel related losses including transit losses and Rs.19.76 crore for other operating expenses such as cost of water, lubricants, consumable stores and station supplies. Out of these, Rs.19.76 crore booked towards other operating expenses do not form part of the fuel cost and are being considered under repair and maintenance expenses in para 2.11. Thus, the net fuel cost as per audited accounts is taken as Rs.2625.80 (2645.56 – 19.76) crore.

2.7.3 The actual fuel cost intimated by the Board for 2007-08 in its ARR of 2009-10 for a gross thermal generation of 16322 MU is based on calorific value and price of coal / oil as given in Table 2.7A. In gross thermal generation, the Board has not taken into account the generation of GHTP Stage II during its trial run. The Board has also intimated that the fuel cost of GHTP Stage II (Units III & IV) has been booked under Capital Cost of the plants and hence the cost of generation of Units III & IV of GHTP Stage II has not been considered as operational (fuel) cost in accordance with CERC Regulations.

The Commission observes that the Board

is still an integrated utility and the power generated during trial run of GHTP

Stage II Units had been injected into the grid of the Board without

consideration of frequency at that time. As such, the Commission is not

inclined to treat the power generated during trial run as power purchased at UI

rate and consequently reduce that amount from the capital cost of the plant.

However, fuel cost of the generation during trial runs will be considered and

allowed as revenue expense.

Table 2.7A: Calorific Value

and Price of Coal and Oil as submitted

by the Board for 2007-08

|

Sr. No. |

Station |

As submitted by PSEB |

||||

|

Calorific value of coal

(kCal/Kg) |

Calorific Value of Oil

(K.cal/Ltr) |

Price of Oil (Rs/KL) |

Price of coal including

transit loss (Rs./MT) |

Transit loss (%) |

||

|

1 |

2 |

3 |

4 |

5 |

6 |

7 |

|

1 |

GNDTP |

4181 |

10056 |

23383 |

2313 |

2.04% |

|

2 |

GGSTP |

3972 |

10000 |

23254 |

2397 |

2.50% |

|

3 |

GHTP |

4153 |

9400 |

19250 |

2354 |

1.49% |

2.7.4

Fuel

cost being a major item of expense, the Commission thought it prudent to get

the same validated. The finally accepted

values are indicated in Table 2.7B.

Table 2.7B: Calorific

Value and Price of Coal and Oil as approved

by the Commission for 2007-08

|

|

As

accepted by the Commission |

|

||||

|

Station |

Gross

Calorific value of coal (kCal/Kg) |

Calorific

Value of Oil (K.cal/Ltr) |

Price

of Oil (Rs/KL) |

Price

of coal including transit loss (Rs./MT) |

Transit

loss (%) |

Price

of coal excluding transit loss

(Rs./MT) |

|

|

1 |

2 |

3 |

4 |

5 |

6 |

|

GNDTP

|

4181 |

10066 |

23383 |

2313 |

1.87% |

2270 |

|

GGSTP |

3972 |

10000 |

23251 |

2397 |

2.40% |

2339 |

|

GHTP |

4153 |

9400 |

19246 |

2354 |

1.49% |

2319 |

2.7.5 In the ARR for the year 2009-10, the Board has not reported any consumption of imported coal for the year 2007-08. This was also verified at the power stations at the time of validation when it was noted that a substantial quantity of coal from the Board’s captive coal mine (PANAM) was used during 2007-08 which is priced F.O.R. destination. The Commission verified that 901533 MT, 1842539 MT and 830668 MT PANAM coal was used at GNDTP, GGSTP and GHTP, respectively, during 2007-08. The price of coal and corresponding calorific values given in the ARR of the Board (as given in Table 2.7A) and those validated by the Commission (as given in Table 2.7B) are weighted average values of coal, including PANAM coal.

2.7.6 The Commission has now approved revised gross thermal generation of 16457 MU (3008 MU for GNDTP, 9806 MU for GGSTP, 3508 MU for GHTP Stage I and 135 MU for GHTP Stage II) as discussed in para 2.4.1. The fuel cost for different thermal stations corresponding to generation now approved has been worked out, based on the parameters adopted by the Commission in its Tariff Order of 2007-08. Price and calorific value of coal and oil has been adopted as validated and accepted by the Commission.

2.7.7 No transit loss has been allowed for PANAM coal while arriving at fuel cost as prices according to the contract are on F.O.R. destination basis. In case of coal other than PANAM coal, transit loss of 2% has been allowed by the Commission.

2.7.8 On the above basis, fuel cost for the year 2007-08 for different thermal stations corresponding to actual generation is given in Table 2.8. As discussed in para 2.7.3, the fuel cost in respect of 135 MU generated by GHTP Stage II (Units III & IV) during their trial run is also included in this cost.

Table 2.8: Fuel Cost- 2007-08

|

Sr.

No. |

Item |

Derivation |

Unit |

Approved

for 2007-08 |

|||

|

GNDTP |

GGSTP |

GHTP |

Total |

||||

|

1 |

2 |

3 |

4 |

5 |

6 |

7 |

8 |

|

1 |

Generation |

A |

MU |

3008 |

9806 |

3643 |

16457 |

|

2 |

Heat

Rate |

B |

k.cal/kWh

Generated |

3000 |

2500 |

2500 |

|

|

3 |

Specific

oil consumption |

C |

Milli

litre/kwh |

3.50 |

2.00 |

2.00 |

|

|

4 |

Calorific

value of oil |

D |

k.cal/litre |

10066 |

10000 |

9400 |

|

|

5 |

Calorific

value of coal |

E |

k.cal/kg |

4181 |

3972 |

4153 |

|

|

6 |

Overall

heat |

F

= (A x B) |

G.cal |

9024000 |

24515000 |

9107500 |

|

|

7 |

Heat

from oil |

G

= (A x C x D) / 1000 |

G.cal |

105975 |

196120 |

68488 |

|

|

8 |

Heat

from coal |

H

= (F-G) |

G.cal |

8918025 |

24318880 |

9039012 |

|

|

9 |

Oil

Consumption |

I=(Gx1000)/D |

KL |

10528 |

19612 |

7286 |

|

|

10 |

Transit

loss of coal |

J |

(%) |

2 |

2 |

2 |

|

|

11 |

Total

Coal Consumption excluding transit loss |

K=(H*1000)/E |

MT |

2132989 |

6122578 |

2176502 |

|

|

12 |

Quantity

of PANAM coal |

L |

MT |

901533 |

1842539 |

830668 |

|

|

13 |

Quantity

of coal other than PANAM coal excluding

transit loss. |

M=K-L |

MT |

1231456 |

4280039 |

1345834 |

|

|

14 |

Quantity

of coal other than

PANAM coal including transit loss |

N=M/(1-J/100) |

MT |

1256588 |

4367387 |

1373300 |

|

|

15 |

Total

Quantity of coal required |

O=L+N |

MT |

2158121 |

6209926 |

2203968 |

|

|

16 |

Cost

of oil |

P |

Rs./KL |

23383 |

23251 |

19246 |

|

|

17 |

Cost

of coal (excluding transit loss) |

Q |

Rs./MT |

2270 |

2339 |

2319 |

|

|

18 |

Total

cost of oil |

R=P

x I / 107 |

Rs.crore |

24.62 |

45.60 |

14.02 |

|

|

19 |

Cost

of coal |

S=O

x Q/107 |

Rs.crore |

489.89 |

1452.50 |

511.10 |

|

|

20 |

Total

Fuel cost |

T=

R+S |

Rs.crore |

514.51 |

1498.10 |

525.12 |

2537.73

|

The Commission, thus, approves the fuel

cost at Rs.2537.73 crore for gross

thermal generation of 16457 MU for the year 2007-08.

2.8

Power Purchase Cost

2.8.1

The Commission, in its Tariff Order for the year 2007-08,

approved a cost of Rs.3410.01 crore for purchase of 13401 MU (gross). In

review, the Commission revised it to Rs.5014.34 crore for the purchase of 14843

MU (gross), inclusive of 4.63% external losses (based on actual external losses

for 2006-07).

2.8.2 The actual gross power purchase for the year 2007-08 now reported by the Board is 17813 MU including unscheduled interchange (UI) of 1952 MU. The net power purchase after accounting for external losses of 4.71% is 16974 MU. The actual cost of power purchase for 2007-08 as per ARR 2009-10 is Rs.6020.42 crore. However, the power purchase cost as per audited accounts for 2007-08 is Rs.6020.37 Crore.

The Commission thus approves a cost of Rs.6020.37 crore for power

purchase of 16974 MU net.

2.9

Expenses Disapproved/Incentive

approved by the Commission

2.9.1

Expenses disapproved on account of higher

T&D losses: As discussed in para 2.3, the Board has under

achieved the T&D loss target approved by the Commission. As per Tariff

Regulations, the entire loss on account of failure of the licensee to achieve

the targets set by the Commission is to be borne by the licensee. As brought out in para 2.6, T&D loss level

higher than that approved by the Commission has resulted in increased power

purchase to the extent of 2714 MU (net), the pro-rata cost of which based on

power purchase cost approved in para 2.8 works out to Rs.962.61 (6020.37 x 2714

/ 16974) crore.

The

Commission, therefore, disapproves expenses to the extent of Rs. 962.61 crore

on account of higher T&D losses.

The effect of this is

reflected at Sr. No. 12 (ii) of Table 2.13.

2.9.2 Incentive for higher Thermal Generation: The Commission has noted higher thermal generation to the extent of 501 MU gross (452 MU net) and consequent less power purchase on this account in para 2.4.1. The station-wise increase in gross generation is 239 (3008-2769) MU for GNDTP and 296 MU for GGSTP (9806-9510). However, the actual gross generation of GHTP is less by 34 MU (3508-3542) than approved by the Commission in the Tariff Order of 2007-08. The net increase in fuel cost for different stations corresponding to this variation in generation based on cost now approved works out to Rs.81.2 crore as given in Table 2.9.

Table 2.9: Increase in Fuel Cost due to higher Thermal

Generation: 2007-08

|

Stations |

Now

approved by the Commission |

Increase

due to higher generation |

||

|

Generation

(MU) |

Fuel

Cost |

Increase

in generation (MU) |

Increase

in Fuel Cost |

|

|

(Rs.

Crore) |

(Rs.

Crore) |

|||

|

2 |

3 |

4 |

5 |

6 |

|

GNDTP |

3008 |

514.51 |

239

|

40.88 |

|

GGSTP |

9806 |

1498.10 |

296

|

45.22 |

|

GHTP |

3643 |

525.12 |

(-)34 |

(-)4.90 |

|

Total |

16457 |

2537.73 |

501

|

81.2 |

The decrease in power

purchase on account of higher thermal generation is 452 MU (net). The pro-rata

cost of 452 MU (net) based on power purchase cost approved as per para 2.8

works out to Rs.160.32 crore (i.e. Rs.6020.37 x 452/16974). Accordingly, the

net saving on account of higher thermal generation is Rs.79.12 (160.32 -81.2) crore.

The Commission, therefore, approves an amount of Rs.79.12 crore as incentive on account of higher thermal generation.

The effect of this is reflected at Sr.

No. 12 (i) of Table 2.13.

2.10 Employee Cost

2.10.1 The Commission, in the Tariff Order of 2007-08, had approved employee cost at Rs.1661.41 crore. In the review of 2007-08 in the subsequent Tariff Order, the Commission had revised the employee cost to Rs.1662.50 crore based on increase of 6.68% in the wholesale price index (WPI) based on latest estimates available for 2007-08. This was in accordance with the PSERC Tariff Regulations which specified that O&M expenses (which included employee cost) would be adjusted according to the annual variation in the rate of WPI.

2.10.2 The

Board has submitted the audited accounts for 2007-08 according to which

employee cost is Rs.2153.09 crore (gross). After deducting capitalization of

Rs.117.81 crore, the cost works out to Rs.2035.28 crore. However, as per Audit

comments in the audited accounts these costs are understated by Rs.6.46 crore

on account of bonus payment booked to bonus payable. Thus, actual employee cost

works out to Rs.2041.74 crore net of capitalization.

2.10.3 The

Board in Petition No.14 of 2008 had pleaded that employee cost should also be

allowed for the assets added during the year from the date of commissioning for

the years 2006-07 and 2007-08 as per Regulation 28 (6) of the PSERC Tariff

Regulations. However, the Commission

while disposing of the petition, in its order dated

2.10.4 The Commission is, thus, only to adjust

employee cost for 2007-08 according to the annual variations in the rate of WPI

as on 1st April. The existing practice, whereby the difference in

the WPI index alone is taken into account, is not fully reflective of the

actual change in whole sale prices over the year. The Commission is, therefore, of the view

that it would be more realistic to take into account the average increase in

WPI in a year rather than merely referring to the difference in the index as it

stood on 1st April of the present and previous year. Accordingly it

is noted that the increase in WPI for the year 2007-08 works out to 4.66% as

against 6.68% allowed in the review. The Commission, therefore, approves

employee cost of Rs.1631.02 crore by allowing an increase of 4.66% over the

approved employee cost of Rs.1558.40 crore for the year 2006-07.

The Commission approves the employee cost of Rs.1631.02 crore for the year 2007-08.

2.11

Repairs

and Maintenance (R&M) expenses

2.11.1 The

Commission had approved R&M expenses at Rs.271.35 crore in the Tariff Order

of 2007-08. In the review, these

charges were revised to Rs.302.95 crore, allowing an increase of 6.68% in WPI

over the R&M expenses approved for the year 2006-07 besides allowing

R&M expenses for the additional assets of Rs.2843.22 crore stated to have

been added during 2007-08, assuming these remained in use for six months in the

year.

2.11.2 R&M expenses as per the audited accounts of the Board for the year are Rs.297.00 crore inclusive of Rs.19.76 crore operating expenses, of which Rs.3.10 crore have been capitalized leaving balance R&M expenses for the year as Rs.293.90 crore. However, as per Audit comments on the audited accounts of 2007-08, these expenses have been understated by Rs.1.19 crore by booking the cost of meters issued for replacement of burnt/damaged meters to capital expenditure. At the same time these charges have been reported to be overstated by Rs.0.31 crore as expenditure of capital nature has been charged to revenue. Thus, actual R&M cost for the year 2007-08 works out to Rs.294.78 (293.90+1.19-0.31) crore.

2.11.3 While disposing of Petition No.14 of 2008, the

Commission in its order dated March 24, 2009, decided to take into account the

base R&M expenses for 2007-08 at Rs.265.45 (254.53+10.92) crore instead of

Rs.259.99 crore (base for 2006-07) considered to work out the R&M expenses

allowable for 2007-08 in the Tariff Order of 2008-09. The PSERC Tariff

Regulations provide for allowing increase in O&M expenses (which include

R&M expenses) in proportion to the annual increase in WPI. After allowing

WPI increase of 4.66%, as discussed in para 2.10.4 of this order over these

expenses, R&M expenses allowable for the year 2007-08 work out to Rs.277.82

crore for assets valuing

Rs.15413.59 crore as on April 1, 2007.

2.11.4 According to Regulation 28 (6) of the PSERC Tariff Regulations, O&M expenses for fixed assets added during the year are to be considered on pro-rata basis from the date of commissioning. As per audited accounts for 2007-08, fixed assets added during the year are valued at Rs.1007.14 crore. However, Audit comments to the audited accounts indicate that these assets have been understated by (i) Rs.4.27 crore on account of completed fixed assets shown as capital work in progress, (ii) Rs.0.31 crore on account of capital expenditure booked to revenue expenditure and (iii) overstated by Rs.1.19 crore on account of cost of burnt/damaged meters booked as capital expenses. Thus, actual fixed assets added during the year works out to Rs.1010.53 (1007.14 + 4.27 + 0.31 – 1.19) crore. By applying an average rate of 1.80% (277.82/15413.59*100), allowable R&M expenses for the additional fixed assets work out to Rs.9.09 crore assuming these assets remained in service for six months in the year.

The Commission

accordingly allows the R&M expenses at Rs.286.91 (277.82+ 9.09) crore for the year 2007-08.

2.12

Administration

and General (A & G) expenses

2.12.1 In

the Tariff Order of 2007-08, the Commission had approved A&G expenses at

Rs.62.41 crore. In the review of 2007-08, these expenses had been increased to

Rs.69.64 crore based on an increase of 6.68% in WPI, for the period from April

2007 to March 2008. This included A&G

expenses for additional assets of

Rs.2843.22 crore stated to have been added during 2007-08 assuming these

remained in use for six months in the year.

2.12.2 As per the audited accounts of the Board,

the A&G expenses for the year 2007-08 are Rs.92.04 crore (gross). Out of

these, expenses of Rs.22.33 crore have been capitalized and the net expenses

amount to Rs.69.71 crore. However, as per Audit comments on the accounts

of 2007-08, these expenses are understated by Rs.0.21 crore due to

non-adjustment of prepaid expenses of previous years. Thus, actual A&G

expenses work out to Rs.69.92 crore for 2007-08.

2.12.3 While disposing

of Petition No.14 of 2008, the Commission in its order dated March 24, 2009,

decided to take into account the base A&G expenses for 2007-08 at Rs.61.08

(58.54+2.54) crore instead of Rs.59.81 crore

(2006-07) taken into account for 2007-08 in the Tariff Order of

2008-09. As discussed in para 2.10.4 of

this order, after allowing WPI increase of 4.66%, A&G expenses allowable

for 2007-08 work out to Rs.63.93 crore which are allowed for assets valuing

Rs.15413.59 crore as on 1st April, 2007.

2.12.4 The Commission adopts the same principle for allowing A&G expenses for fixed assets added during the year as has been applied to R&M expenses in para 2.11.4 of this order. Accordingly, the average rate of 0.41% (63.93 / 15413.59 * 100) is applied to the capital cost of additional assets of Rs.1010.53 crore added during 2007-08 for arriving at additional A&G expenses of Rs.2.07 crore.

The Commission, therefore, approves the

A&G expenses of Rs.66.00 (63.93 + 2.07) crore for the year 2007-08.

2.13

Depreciation

charges

2.13.1 The Commission had approved depreciation charges at Rs.696.82 crore for the year 2007-08 in the Tariff Order of 2007-08. In the review of 2007-08 in the following Tariff Order, these charges were revised to Rs.640.06 crore based on the revised estimates of the Board.

2.13.2 The Board has claimed depreciation charges of Rs.665.15 crore for the year 2007-08 in the ARR. However, by applying the average rates of depreciation to the opening balances of Assets as on April 1, 2007, the correct amount of depreciation works out to Rs.664.89 crore as detailed in Table 2.10 below.

Table 2.10: Depreciation charges

(Rs. crore)

|

Sr.No. |

Item |

Assets

as on |

% Rate |

Claimed

by Board |

Approved Depreciation charges for 2007-08 |

|

1 |

2 |

3 |

5 |

6 |

7 |

|

1 |

Thermal |

2915.31 |

5.47% |

159.33 |

159.47 |

|

2 |

Hydro |

5,774.79 |

2.24% |

129.57 |

129.36 |

|

3 |

Internal combustion |

2.68 |

0.00% |

- |

- |

|

4 |

Transmission |

1,898.62 |

4.83% |

91.79 |

91.70 |

|

5 |

Distribution |

4,685.45 |

6.03%

|

282.63 |

282.53 |

|

6 |

Others |

136.74 |

1.34% |

1.83 |

1.83 |

|

7 |

Total |

15413.59 |

4.34% |

665.15 |

664.89 |

In view of the above,

the Commission approves depreciation charges of Rs.664.89 crore for the year 2007-08.

2.14

Interest

and Finance charges

2.14.1

The Commission had approved net Interest and

Finance charges of Rs.693.75 crore in the Tariff Order of 2007-08 after

disallowing interest cost of Rs.100 crore in the case of the Board and Rs.289.92 crore of interest paid/payable

on Govt. loans on account of diversion of capital funds for revenue

purposes. In the review of 2007-08,

the Interest & Finance charges were revised to Rs.634.04 crore mainly on

account of variations of interest on working capital.

2.14.2 The

gross amount of Interest and Finance charges as per the audited accounts for

2007-08 is Rs.1085.39 crore. The amounts not claimed by the Board and the

amount of Interest and Finance charges allowed/disallowed by the Commission are

tabulated in Table 2.11.

Table

2.11: Interest and Finance charges

(Rs.

crore)

|

Sr. No. |

Description |

Interest as

depicted in accounts |

Interest

paid to the Govt. but not accounted for |

Amount

disallowed by Commission |

Amount allowed

by Commission |

|

1. |

Interest on institutional loans taken by the

Board |

509.47 |

- |

7.79 |

501.68 |

|

2. |

Interest on Govt. loans |

85.99 |

275.89 |

- |

361.88 |

|

3. |

Interest on GPF |

108.38 |

- |

- |

108.38 |

|

4. |

Lease rentals |

1.52 |

- |

- |

1.52 |

|

5. |

Interest to consumers |

4.73 |

- |

- |

4.73 |

|

6. |

Sub-total |

710.09 |

275.89 |

7.79 |

978.19 |

|

7. |

Interest on WCL of Rs.4420 crs against admissible

loans of Rs.878.50 crs on normative basis |

365.78 |

- |

253.77 |

112.01 |

|

8. |

Interest on loans of Rs.265 crs. taken for

Talwandi Sabo TP being developed by a Pvt. Company TSPL |

1.16 |

- |

1.16 |

0.00 |

|

9. |

Interest paid but not due as per Audit comments |

0.80 |

- |

0.80 |

0.00 |

|

10. |

Finance charges for loans of Rs.1384.18 crs. including loan of Rs.265 crs. taken for TSPL |

7.56 |

- |

2.32 |

5.24 |

|

11. |

Total

(6+7+8+9+10) |

1085.39 |

275.89 |

265.84 |

1095.44 |

|

12. |

Less capitalization |

221.77 |

- |

- |

221.77 |

|

13. |

Net Interest & Finance charges (11-12) |

863.62 |

- |

- |

873.67 |

|

14. |

Less interest disallowed on account of diversion |

|

|

|

419.05 |

|

15. |

Interest allowed (13-14) |

|

|

|

454.62 |

|

16. |

Additional interest allowed for loans of Rs.1362

crs taken in lieu of Govt. loans |

|

|

12.33 |

12.33 |

|

17. |

Total Interest (15+16) |

|

|

|

466.95 |

The reasons for allowing/disallowing the amount of interest as given

above are discussed in the succeeding paragraphs.

2.14.3 In

the Tariff Order of 2008-09, the Commission had approved an Investment Plan of

Rs.1500 crore for the year 2007-08. However, net investment of Rs.1281 crore

was approved after adjustment of Rs.219 crore consumers’ contribution

considered at previous year’s level as audited accounts for 2007-08 were not

available. Against this, actual capital expenditure of the Board for 2007-08 is

Rs.1535.30 crore inclusive of Rs.314.40 crore for Talwandi Sabo Power Ltd.

(TSPL) and Rs.8.50 crore for Rajpura Thermal Plant. The investment on these

plants is not to be considered towards the investment plan of the Board since

these plants are to be privately developed. Thus, actual capital expenditure of

the Board works out to Rs.1212.40 crore. As per the audited accounts,

consumers’ contribution for 2007-08 is at Rs.215.58 crore. In addition, the

Board had also received an incentive grant of Rs.44.14 crore under APDRP during

2007-08. As these no cost funds were available with the Board for investment,

actual need for capital loans works out to Rs.952.68 (1212.40-215.58-44.14) crore. The interest on institutional loans actually

availed by the Board for this purpose is Rs.509.47 crore in 2007-08. The

Board’s interest liability on allowable loans of Rs.952.68 crore (against

Rs.1119.18 crore actually availed) works out to Rs.501.68 crore on

proportionate basis against the claim of Rs.509.47 crore.

2.14.4 The

Board has claimed interest of Rs.85.99 crore paid to the Govt. against actual

interest due and payable of Rs.361.88 crore @ 12.22% on Govt. loans for 2007-08.

Thus, the Board has not accounted for Govt. interest of Rs.275.89

(361.88-85.99) crore in its accounts. In order to arrive at the amount of gross

interest payable in 2007-08, Rs.275.89 crore needs to be added to Rs.1085.39 crore.

2.14.5 The

audited accounts include interest of Rs.108.38 crore on GPF, Rs.1.52 crore

lease rentals and Rs.4.73 crore being interest paid to consumers on actual

basis. Therefore, interest charges on these accounts are allowed on actual

basis.

2.14.6 In the ARR of 2009-10, the Board has

claimed interest of Rs.365.78 crore on working capital loans of Rs.4420 crore

for 2007-08. However, working capital loans of Rs. 878.50 crore are admissible

on normative basis on which interest charges work out to Rs.112.01 crore at an

interest rate of 12.75% being the PLR of SBI as on April 2007. Accordingly,

Rs.253.77 (365.78-112.01) crore is disallowed being interest on excess working

capital loans availed by the Board.

2.14.7 In the audited accounts for 2007-08,

interest of Rs.1.16 crore on loans taken for the Talwandi Sabo Thermal Plant,

which is to be privately developed on Build Own Operate (BOO) basis, has been

included. The claim of interest of Rs.1.16 crore on this account is not

admissible and accordingly disallowed from the total Interest and Finance

charges for 2007-08.

2.14.8 As

per Audit comments, interest of Rs.0.80 crore which was not due but paid by the

Board is included in the audited accounts. This amount is also disallowed

taking into account the Audit comments.

2.14.9 In the Tariff Order of 2007-08, the Commission had approved Finance charges at Rs.12.08 crore which was revised to Rs.12.45 crore (inclusive of Rs.4 crore payable as interest to consumers) in the Tariff Order of 2008-09. The net amount of Finance charges is Rs.7.56 crore as per audited accounts for 2007-08. These charges are for actual loans of Rs.1384.18 (1119.18+265) crore inclusive of loans of Rs.265 crore taken for TSPL. Thus, the percentage rate of Finance charges works out to 0.55%. However, allowable capital loans approved by the Commission are Rs.952.68 crore. By applying this rate, the allowable Finance charges comes to Rs.5.24 crore resulting in disallowance of Rs.2.32 crore on account of excess loans. Accordingly, Finance charges of Rs.5.24 crore are approved for 2007-08.

2.14.10 After taking into account the above decisions, total Interest

and Finance charges of the Board work out to Rs.1095.44 crore against

Rs.1085.39 crore as per accounts (Table 2.11). After allowing capitalization of interest charges of Rs.221.77 crore as

per accounts, the net Interest and Finance charges comes to Rs.873.67 crore

against Rs.863.62 crore as per accounts.

2.14.11 The Commission had disallowed

Rs.389.92 crore from the Interest and Finance charges on account of diversion

of capital funds in the Tariff Order of 2007-08. This amount was revised to Rs.389.15 crore in

the review. The Commission has now reworked the diversion of capital funds

based on the audited accounts of the Board for 2007-08 which is given in Table

2.12 below.

Table 2.12: Diversion of Capital Funds

(Rs. crore)

|

Sr. No. |

Item |

Year 2007-08 |

|

1 |

Net Fixed

Block |

9009.80* |

|

2 |

Works in

progress (WIP) during the year |

3590.78** |

|

3 |

Inventory

at Const. Stores |

155.38 |

|

4 |

Total

(1+2+3) |

12755.96 |

|

5 |

Less

Consumers’ contribution and grants & subsidy towards cost of capital

assets |

2942.84 |

|

6 |

Balance

capital base (4-5) |

9813.12 |

|

7 |

Requirement

of Loans +equity |

9813.12 |

|

8 |

Average

Govt. Loans for the year |

2961.41*** |

|

9 |

Average loans

on account of recalled overdue Govt. loans |

113.50**** |

|

10 |

Other

loans (excluding loans taken for TSPL) |

6202.23 |

|

11 |

Equity |

2946.11 |

|

12 |

SBI Bonds |

637.35 |

|

13 |

GPF

utilized by Board ( Accumulations in GPF Less amount invested) |

1019.08 |

|

14 |

Actual

Loans + Equity (8+9+10+11+12+13) |

13879.68 |

|

15 |

Less

capital base |

9813.12 |

|

16 |

Amount

diverted (14-15) |

4066.56 |

|

17 |

Less Bonds for which debt servicing under-taken by Govt. |

637.35 |

|

18 |

Balance diverted amount (16-17) |

3429.21 |

|

19 |

Interest effect @12.22% |

419.05 |

Note:

* Net fixed assets as per

audited accounts is Rs. 9006.41 crore. However, these

assets have been understated by Rs.3.39 crore as per audit comments. Thus,

actual net fixed block for 2007-08 is Rs.9009.80 crore.

** WIP during 2007-08 as per

audited accounts is Rs.3784.79 crore. This amount is overstated by Rs.189.74 crore

being share of assets of Irrigation Branch of the State Govt. and by Rs.4.27 crore

being value of assets completed but still reflected in WIP for the year. Thus,

net WIP after adjustment works out to be Rs.3590.78 crore.

*** Average Govt. loans=

Rs.3074.91 crore for 11 months and Rs.1712.91 crore for 1 month (March, 2008) =

Rs.2961.41 crore.

****Recalled overdue Govt.

loans of Rs.1362 crore adjusted against subsidy in February 2008 considered for

one month. Average loans =Rs.1362/12=Rs.113.50 crore.

The diversion of capital funds for revenue purposes for the year works

out to Rs.4066.56 crore out of which debt servicing of the SBI bonds of

Rs.637.35 crore will have no effect on interest charges of the Board as the

same has been taken over by the Govt. Therefore, the net diverted amount

carrying interest liability is Rs.3429.21 crore on which interest works out to

Rs.419.05 crore at an average rate of 12.22%, which is disallowed. The

Commission retains its decision regarding disallowance of interest of Rs.100 crore

out of this amount on account of deficiencies in the functioning of the Board.

The balance of Rs.319.05 crore is disallowed from the interest on Govt. loans

for diversion of capital funds. Accordingly, interest payable by the Board on

Govt. loans stands reduced to Rs.42.83 (361.88-319.05) crore.

2.14.12 The Board indicated that the Govt. had recalled its overdue loans of Rs.1362 crore in February, 2008 and adjusted the same against balance unpaid subsidy for 2007-08. The Board made additional claim of interest for loans of Rs.1362 crore taken in lieu of recalled Govt. loans and interest of Rs.501 crore excess paid and not refunded by the Govt. The Board has requested that borrowings on these counts may be segregated from the normal working capital borrowings and the carrying cost to service the short term borrowings on this account be allowed and the same need to be borne by the Govt.

As regards loans of 1362 crore taken to replace the loans recalled by the Govt. the Commission is convinced that the plea of the Board carries weight and interest on this account is allowable to the Board. Accordingly, interest of Rs.12.33 crore for March, 2008 on short term loans of Rs.1362 crore @ 10.86% p.a. as claimed by the Board is allowed. However, the Commission does not concur with the view that interest to this extent be borne by the Govt. It is clarified that before the recall of overdue loans by the Govt., the interest on Govt. loans of Rs.1362 crore formed part of the ARR of the Board. Since only the source of loan has changed, there is no need to shift the liability of interest to the Govt. Interest liability on account of diversion of capital funds is already being disallowed and adjusted, in part, against interest on Govt. loans. Hence, the Commission decides that the interest cost of Rs.12.33 crore will be borne by the consumers as heretofore.

2.14.13 As

regards the Boards’ claim for allowing carrying cost of loans taken to finance

the non-refund of Rs.501.07 crore, the Commission had in para 4.13 of its order

dated September 13, 2007 disallowed interest of Rs.289.92 crore on Govt. loans

on account of diversion of capital funds for 2006-07. For 2007-08, the

Commission had disallowed interest of Rs.289.15 crore on this account based on

2006-07 accounts of the Board and interest of Rs.72.88 crore was determined as

payable to the Govt. Since for 2007-08, the interest already paid to the Govt.

was stated at Rs.194.10 crore, as interest to the Govt., it resulted in excess

payment of interest of Rs.121.22 crore. Accordingly, in para 6.8.7 of the

Tariff Order of 2008-09, the Commission had decided that total overpaid amount

of interest upto 2008-09 comes to Rs.411.14 (289.92+121.22) crore. However, as

decided in para 2.14.11 of this order, interest payable to the Govt. is revised

to Rs.42.83 crore for 2007-08. Against

this, interest of Rs.85.99 crore was paid on Govt. loans as per the audited

accounts of the Board. Thus, excess paid

interest on Govt. loans for 2007-08 comes to Rs.43.16 (85.99-42.83) crore.

Accordingly, actual interest paid in excess to the Govt. by the Bo

Accordingly, the Commission approves the net

Interest and Finance charges of Rs. 466.95 crore for the year 2007-08

(Table 2.11).

2.15

Return

on Equity

2.15.1 In the Tariff Order of 2007-08, the

Commission had in accordance with Regulation 25 of the PSERC Tariff Regulations,

approved a return of Rs.412.46 crore calculated at 14% on the equity of Rs.2946.11

crore as on

2.15.2 In

the review for the year 2007-08 in the Tariff Order of 2008-09, the Commission

retained return on equity at Rs.412.46 crore for that year. As per the audited

accounts of the Board for the year 2007-08, the Govt. equity in the Board

remained unchanged at Rs.2946.11 crore.

Accordingly, the

Commission retains Return on Equity at Rs.412.46 crore for the year 2007-08 as

earlier approved.

2.16 Subsidy and other amounts payable

by the Government

2.16.1 As

per the audited accounts for the year 2007-08, total subsidy of Rs.2848.04 crore

has been paid by the Govt. to the Board.

2.16.2 The subsidy payable by the Govt. is now trued up as under:

·

AP Consumption: The Commission has

accepted AP consumption at 8902 MU on which revenue for 4372 MU (upto 31.8.07)

@ 214 paise per unit works out to Rs.935.61 crore and for 4530 MU (1.9.07 to

31.3.08) @ 240 paise comes to Rs.1087.20 crore totaling Rs.2022.81 crore. Of

this, consumers have been billed for Rs.18.04 crore and the balance of Rs.2004.77

crore exclusive of meter rentals and service charges of Rs.7.00 crore was

payable by the Govt. as AP subsidy.

·

Scheduled Castes (SC) Domestic

Supply (DS) Consumers: The

Commission notes that as per the decision of the Govt., Scheduled Castes DS

consumers with a connected load upto1000 watts will be given free power upto

200 units per month. The Board has now reiterated its claim to subsidy of

Rs.206.73 crore, inclusive of meter rentals and service charges of Rs.9.78 crore,

as approved earlier in review in the Tariff Order of 2008-09, which the

Commission, retains.

·

Non-SC Below Poverty Line (BPL)

Consumers: The Govt. had also decided to give free supply of

power upto 200 units per month to Non-SC BPL DS consumers with connected load

upto 1000 watts. The Board has claimed subsidy on this account of Rs.1.27 crore

inclusive of meter rentals and service charges of Rs.0.06 crore which is the

same as approved by the Commission in review of 2007-08 in the Tariff Order of

2008-09. The Commission retains this approval.

·

Additional Subsidy to neutralize the effect

of enhanced tariff: The Govt. had decided to neutralize the effect of

enhanced tariff to all categories of consumers which was ordered by the

Commission w.e.f. 1st September

2007 in the Tariff Order of 2007-08. The Commission had determined

in the Tariff Order of 2008-09 that Rs.292.66 crore would be the additional

subsidy payable on this account to the Board. However, the amount of Govt.

subsidy actually payable is trued up to Rs.298.66 crore based on actual

consumption data supplied by the Board.

On the above basis, total subsidy payable by the Govt. for the year 2007-08 works out to Rs.2518.43 (2004.77+7+206.73+1.27+298.66) crore.